|

Displaying items by tag: Warhol

In the middle of Christie’s “Post-war and Contemporary Art” sale last week, just as bidding for Andy Warhol’s blue photo-booth self-portrait was beginning to heat up (the work eventually sold for over $38 million, including premium), art dealer Larry Gagosian turned questioningly to Warhol collector/dealer José Mugrabi. According to Artnet.com’s Walter Robinson, Gagosian had just bid $20 million on the piece, and been upped by $500,000. Mugrabi shook his head,and Gagosian dropped out of the running.

While I can’t know exactly what was going through each man’s thoughts, I do know that they are two of the top buyers at auction these days. They know what they’re doing. And in this case, they were right.

Ideally, of course, one buys a work of art for love, and not investment. Ideally, the money and the future value of the work are unimportant.

But when you’re talking 20 or 30 million, you care. Of course you care.

Which is why buying a $30 million Warhol painting is actually a pretty foolish move. And Gagosian and Mugrabi knew it.

Sure, when a Warhol goes for that much, it increases the value of all the other Warhols you own – just as when one fails to sell at a similar price, your collection’s value will fall. Any investor understands this, which is why, when it comes to stocks and commodities, no one puts all his pennies in the same bucket.

Yet somehow, when social prestige is at stake – and let’s face it, in certain circles, that’s what owning a Warhol self-portrait is all about – perfectly intelligent, savvy investors behave like total idiots.

In truth, as art market expert Anders Petterson told a New York audience recently, “as an investor, you’d be better off putting the money into a mid-tier category” – between $500.000 and $5 million, according to Bloomberg news. (I would suggest “mid-tier” starts quite a bit lower, but you get the point.)

Phillips de Pury & Co. scored its second-highest tally ever for a contemporary art sale in New York last night, boosted by a hot property from hedge-fund manager Steven Cohen.

The founder and chairman of SAC Capital Advisors LP consigned Andy Warhol’s portrait of Elizabeth Taylor, and the late screen idol was the star of the evening’s 50-lot sale.

With two telephone bidders dueling for the work, the 40- inch-square 1963 canvas titled “Liz #5” fetched $26.9 million, falling within its target range of $20 million to $30 million.

The sale brought in $98.8 million, close to the low end of the forecast $84.5 million to $121.4 million, and 22 percent of the lots failed to sell. Still, the total was more than double the boutique auction house’s tally of a year ago.

“They are definitely the underdog and they are hanging in there. It’s remarkable,” said Wendy Cromwell, New York art adviser, comparing Phillips with much bigger players Sotheby’s (BID) and Christie’s International.

In “Liz #5,” the legendary actress, who died in March, is depicted with a clownlike red mouth and turquoise eye shadow that matches the background. The painting used to belong to the influential art dealer Ileana Sonnabend. Six months after her death in October 2007, her heirs sold the work to the Gagosian gallery along with other Warhols from her collection.

A Maurice de Vlaminck landscape from Cohen’s collection sold at Christie’s last week for $22.5 million. Together the two works brought in $49.4 million.

Another 1963 turquoise “Liz” appeared on the market in 2007. Consigned by actor Hugh Grant, it fetched $23.6 million at Christie’s in New York.

More Warhol

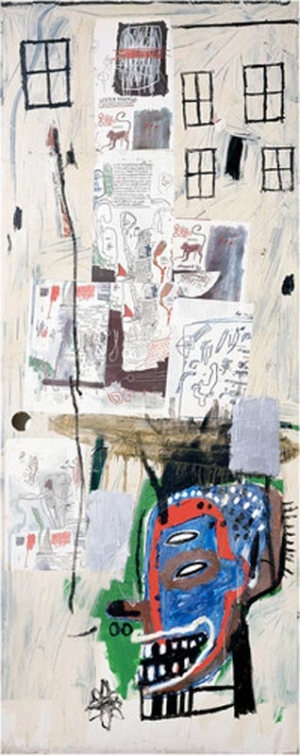

Warhol accounted for four of the top 10 lots; in addition, his collaboration with Jean-Michel Basquiat titled “Third Eye” was the third-priciest piece at $7 million, more than double its $3 million high estimate.

The market for trophy art roared back after a three-night case of the blahs as Christie’s International saw its biggest tally for a New York evening contemporary-art sale since May 2008.

All but three of the 65 lots sold last night, with Cy Twombly and Richard Diebenkorn paintings setting records and a Cindy Sherman fetching the highest price ever for a photo at auction, $3.9 million.

The $301.7 million total surpassed the $299 million high presale estimate and was the closely held auctioneer’s largest in the category since the market was sideswiped by the world financial crisis.

The top lot was Andy Warhol’s 1963-64 “Self- Portrait,” made of four photo-booth-strip images in different shades of blue.

It went for $38.4 million, above the $30 million high estimate, after a tortuous -- some dealers said tedious -- bidding war between private art dealer Philippe Segalot and a telephone client of Brett Gorvy, deputy chairman and international head of postwar and contemporary art at Christie’s. The price was an auction record for a Warhol portrait.

Dealers said the evening offered rarer works than Sotheby’s (BID) $128.1 million contemporary sale the previous night. Collectors and dealers had likewise complained that the two Impressionist and modern evening sales last week skimped on masterpieces.

‘Night and Day’

“It’s like night and day,” said Lucy Mitchell-Innes, a New York art dealer. Sotheby’s on Tuesday night “was dreary and a real struggle. It’s all about quality.”

Both of the major Sotheby’s New York evening sales were at the low end of their estimates. The auctioneer’s shares are off 23 percent since April 5.

Another highlight at Christie’s was an undocumented 1961 painting by Mark Rothko that went for $33.7 million, above the high presale estimate of $22 million. Classical postwar works by Roy Lichtenstein, Alexander Calder and Sam Francis brought strong results.

“Quality speaks,” said Daniella Luxembourg, private art dealer in New York and London. “The rarity of things like Rothko is covering the aggressive estimates.”

‘Because I Love It’

The most aggressively estimated Warhol of the season didn’t fare as well. A 1986 self-portrait of the artist in a spiky wig sold for $27.5 million, missing the low estimate of $30 million. It landed with the Mugrabi family, known for its vast Warhol collection and steadfast support of the artist’s market.

When asked why he bought the Warhol, Jose Mugrabi said, “Why? Because I love it. I have no client for it.”

As postwar and contemporary art auctions begin in New York this week, 66 Andy Warhol lots will test the market’s appetite for one of its biggest stars. What’s the best buy?

“As an investor, you’d be better off putting the money into a mid-tier category,” said Anders Petterson, founder of London-based art-market research firm ArtTactic Ltd., speaking at a recent conference in New York. “There’s still a sense of rarity in this segment, but at the same time more liquidity than at the high end.”

Art is a tricky investment, its value influenced by economic cycles, clandestine deals, irregular supply and demand, plus sudden shifts in taste.

Warhol prices this week range from a simple black-and-white photo-booth strip estimated at $10,000 to $15,000 to a stark red self-portrait with spiky hair on black background for $30 million to $40 million.

The mid-tier market falls between $500,000 and $5 million. In 2010, buyers in this category snapped up works from the “Mona Lisa” series, smaller Mao paintings, dollar signs, 24- inch flower paintings and 1963 “Jackie” portraits.

This price bracket accounted for 29 percent of all Warhol lots sold in 2010, versus 8 percent that fetched $5 million or more.

Highlights include a somber round 1964 “Jackie” silkscreen painting from the estate of San Francisco art patron Dodie Rosekrans with an estimate range of $3 million to $4 million at Sotheby’s. (BID)

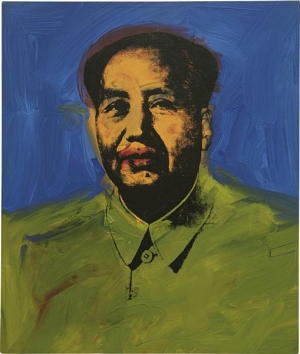

Small Mao

Phillips de Pury has a small 1973 Mao silkscreen painting with an estimated range of $3.5 million to $4.5 million. Depicted in a green frock on blue background, this Mao was part of a batch of Warhols from the Sonnabend Collection acquired by Larry Gagosian in 2008.

Christie’s has a 90-by-70-inch canvas “Diamond Dust Shoes” (1980-81) in which high-heeled sandals are sprinkled with diamond dust, for $1 million to $1.5 million.

“If you can buy a 90-by-70 Warhol shoe painting for $1 million, it’s better than owning Google, Microsoft and Facebook together,” said Alberto Mugrabi, New York-based collector and dealer in Warhol. “I am not involved in selling this work, but I will be involved in the buying.”

A racy Jeff Koons sculpture and an assemblage of Jackie Kennedy portraits by Andy Warhol drew tepid bidding last night as Sotheby’s New York saw its lowest tally for an evening contemporary-art auction in two years.

The $128.1 million total was just over the low presale estimate of $120 million. As in last week’s Impressionist and modern-art sales, buyers balked at what they perceived as aggressive estimates and lackluster quality.

“There’s nothing really outstanding here,” billionaire collector Eli Broad said as he left the Manhattan salesroom with his wife, Edythe. “There’s no excitement.”

The top lot was Warhol’s “Sixteen Jackies,” assembled by the seller from 16 individual canvases of the former First Lady on the day of her husband’s assassination. It fetched $20.2 million, or $1.3 million per painting, compared with presale expectations of $20 million to $30 million. Painted with blue, white and gold, some images show Jackie Kennedy smiling, others grief- stricken.

Individual “Jackie” silkscreen paintings sell privately for between $800,000 and $1.2 million, dealers said.

“It’s the perfect example of people willing to pay the market price but no more,” said Todd Levin, director of New York-based Levin Art Group.

“The sale felt overestimated by about 10 to 15 percent,” he said. “If you are going to have aggressive estimates, you’ve got to have masterpieces.”

‘Pink Panther’

A Jeff Koons sculpture depicting a topless blonde hugging the Pink Panther fetched $16.9 million, falling short of the presale estimate of $20 million to $30 million and of the artist’s auction record. The porcelain piece went to a telephone client of Patti Wong, chairman of Sotheby’s Asia.

Described as one of the most important works by Koons, “Pink Panther” (1988) was consigned by publisher Benedikt Taschen, who had been guaranteed an undisclosed amount through a third-party irrevocable bid.

The auction record for a Koons sculpture is $25.8 million paid for “Balloon Flower” at Christie’s in London in 2008. Sotheby’s (BID) priciest Koons was a giant magenta-and- gold “Hanging Heart” that fetched $23.6 million in November 2007.

An Andy Warhol self-portrait completed shortly before his death is expected to sell for as much as $40 million at auction next month, Christie's said on Wednesday.

"Self-Portrait," a large haunting depiction of Warhol rendered in deep red and black, was done in 1986 and displayed in a widely praised gallery show in London just months before he died after routine surgery in New York.

"It is a rare event that a work of this grandeur and stature comes to market," said Amy Cappellazzo, Christie's international co-head and deputy chairman of post-war and contemporary art.

"With all the other examples in museums, it will be the last chance that buyers will have to bid on a work that shifted art history," she added about the sale on May 11.

The 40-year-old ex-JPMorgan (JPM.N) banker with a penchant for works by pop artist Andy Warhol had created a $600 million hedge fund and was preparing to move to Asia to woo the region's deep-pocketed investors.

After making a big impression on the Singapore art scene with his recent Warhol exhibition, Moccia was confident the brewing U.S. subprime mortgage meltdown could not dent his plan to stoke returns from his "Cannonball" fund with art and real estate investments.

"I had received a working permit from the Singapore authorities," recalls Italian-born Moccia, speaking from his London office. "The future was bright."

Moccia never got there.

His sprawling portfolio -- including holdings in everything from leveraged hedge funds, pop-art prints of Superman and boutique hotels in Bali -- was suspended in October 2008 when the financial crisis peaked. Moccia's diversification only left him more exposed.

Long before BMW commissioned him to paint an art car, Andy Warhol had translated an abiding fascination with automobiles into work. A new show at the Montclair Art Museum in New Jersey includes some 40 works and other items on the exhibition theme, “Warhol and Cars.”

The show’s linchpin is a Warhol painting owned by the institution, “Twelve Cadillacs,” which depicts a dozen repeated views of the front of a 1963 Fleetwood 60 Special. To Warhol, the Cadillac was as iconic as Mickey Mouse, Marilyn Monroe, the Campbell’s soup can or the Coca-Cola bottle. The painting was one of several automotive-themed Warhol works published in the November 1962 edition of Harper’s Bazaar, when the magazine commissioned Warhol to produce a visual commentary on the automobile.

The cultural importance of Cadillacs and other cars is given some context with the show’s inclusion of advertisements, brochures and design drawings from the Jean S. and Frederic A. Sharf Collection of American Automobile Art.

London’s February series of evening contemporary-art auctions raised 56.2 percent more than last year, boosted by works by Francis Bacon and Andy Warhol, and phone bidding from a widening range of international clients.

The auctions at Sotheby’s, Christie’s International and Phillips de Pury & Co. raised 155.1 million pounds ($251 million), up from 99.3 million pounds last year, according to Bloomberg News calculations.

“There’s a feeling among investment-driven collectors that art has been tested and it’s passed,” Anders Petterson, founder of the London-based research company ArtTactic, said. “People have been surprised how quickly the market has recovered and how blue-chip works have held their value.”

Dealers said the sales were helped by Russian and Asian buyers and the sale of the 43.7 million-pounds of contemporary works from a private collection. These boosted the Sotheby’s total to 88.3 million pounds. Christie’s raised 61.4 million pounds, the most for a contemporary-art auction in the U.K. capital since July 2008, as New York dealer Larry Gagosian paid 10.8 million pounds for a Warhol self portrait. Two years earlier, during the financial crisis, the auction house’s entire sale raised 8.4 million pounds. Phillips added 5.4 million pounds to the tally.

A pile of porcelain sunflower seeds, an Andy Warhol painting of Marilyn Monroe and a Gerhard Richter abstract sold last night at a London auction that was interrupted by a protest at U.K. government cuts.

Sotheby’s evening sale of contemporary art, which raised 44.4 million pounds ($72 million) with fees, briefly stalled when more than 10 activists from the Arts Against Cuts group unfurled a red banner reading “Orgy of the Rich’’ and threw photocopied 50-pound notes at onlookers.

The disruption didn’t stop spending by the world’s rich art collectors. Auction sales of contemporary works are recovering after the financial crisis wiped as much as 50 percent off the value of some pieces.

“There are new buyers in the market,’’ London-based dealer Stephen Friedman said. “There was a lot of bidding from Russia and Asia, some not very discriminating. Tonight did include some good pieces. Overall, demand was strong.’’

The sale began with a pile of Ai Weiwei hand-painted seeds of the same type that the Chinese artist has used to cover the floor of Tate Modern’s Turbine Hall. The 100-kilogram mound sold to one of three telephone bidders for 349,250 pounds, almost tripling the high estimate of 120,000 pounds.

|

|

|

|

|