|

Displaying items by tag: Sotheby's

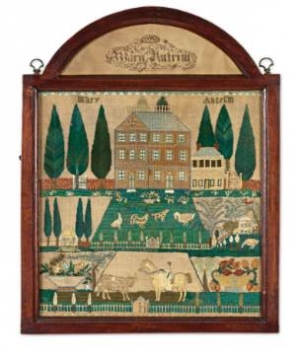

Sotheby’s Americana Week auctions concluded today in New York with a combined total of $17,900,261 – Sotheby’s highest total for this annual week of sales since 2007. The Important Americana auction on Friday and Saturday was led by two record-setting results: the previously undocumented Exceptional Lieutenant Colonel Oliver Arnold Shell-Carved and Figured Mahogany High Chest of Drawers with Open Talons made by John Townsend in 1756, which set an auction record for any high chest of drawers in selling for $3,554,500 (est. $2/3 million*), and An Extremely Rare and Highly Important Gold-Inlaid and Deep Relief Engraved Colt Model 1849 Pocket Revolver, Samuel Colt, Hartford, Connecticut, circa 1853 that brought $1,142,500 and set a record for any single firearm at auction (est. $800,000/1.2 million). On Sunday, Important American Schoolgirl Embroideries: The Landmark Collection of Betty Ring totaled $4,389,503 – exceeding its pre-sale high estimate of $3.4 million – and set a new auction record for any needlework sampler at auction when a Rare and Important Needlework Sampler, Mary Antrim, Burlington Country, New Jersey, Dated 1807 achieved $1,070,500, more than ten times its high estimate of $120,000 (pictured next page).

Important Americana – 20 & 21 January 2012

The first day of the Important Americana sale saw top prices for American silver, featuring an exceptional group of 17th, 18th and 19th century pieces from First Parish Church in Dorchester, Massachusetts that brought a total of $1,721,313, led by The Governor Stoughton Cups: A Rare Pair of American Silver Standing Cups that achieved $1,082,500 (est. $1/2 million). The Church will use the proceeds from the sale of this historical group to move its mission in the Dorchester community into the 21st century – not only by updating the physical building and its systems, but also becoming a resource and active center for its multi-faceted community.

In addition to strong prices for American furniture and decorative arts, Saturday’s session saw several remarkable results for American folk art:

Ammi Phillips’s Portrait of a Winsome Young Girl in Red with Green Slippers, Dog and Bird, circa 1840 – one of only 11 portraits in red by the artist – well exceeded its $500,000 high estimate in selling for $806,500, while a View of the John Hancock House, Beacon Hill, Boston

(Fireboard / Overmantel) painted circa 1780 achieved $614,500 above a high estimate of $250,000. The work is one of the earliest and most

complete views of the famous Hancock residence.

Important American Schoolgirl Embroideries: The Landmark Collection of Betty Ring – 22 January 2012

In addition to the record-setting result for the Mary Antrim sampler (pictured left), Sunday’s auction dedicated to the celebrated collection of Betty Ring was highlighted by several pieces that greatly exceeded pre-sale expectations: a Fine and Rare Needlework Sampler, Susannah Saunders, Sarah Stivours School, Salem, Massachusetts, Dated 1766 nearly quadrupled its high estimate of $80,000 in achieving $314,500; a Fine and Rare Needlework Sampler, Betsy Gail, Marblehead, Massachusetts, circa 1790 brought $170,500 above a high estimate of $60,000; and a Rare Needlework Sampler, Sarah Cooper, attributed to Ann Marsh’s School, Philadelphia, Pennsylvania,

Dated 1792 sold for $170,500 above a high estimate of $80,000.

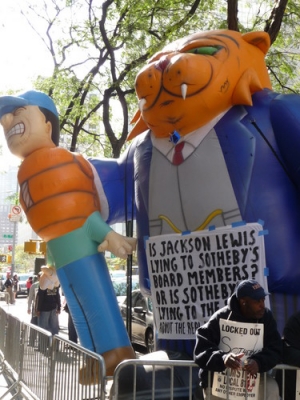

A four-month labor dispute at Sotheby’s (BID) has brought out actress Susan Sarandon and hundreds of Occupy Wall Street protesters on an issue that comes down to who gets to haul the Chippendales and Picassos.

A month after a three-year contract expired, the New York- based auction house imposed a lockout on July 29 on the 42 union workers known as art handlers. Their job involves moving expensive collectibles from showroom to salesroom for waiting bidders.

Sotheby’s said the lockout prevented the workers from scheduling a strike to cause maximum disruption and cost to the auction house.

The handlers belong to Local 814 of the International Brotherhood of Teamsters, which has accused the auctioneer of seeking savings that will weaken the union and cut pay. During the lockout, the handlers receive unemployment benefits plus $200 a week from their union. Their health insurance expires in January, the union said.

“You have to decide what’s more important to you, watching ‘Barney’ or eating,’” said handler Roger Ousley, a father of four who temporarily suspended cable television in his Bronx home.

Sotheby’s, which is using temporary workers to handle items for auction, said it’s eager for a resolution. The temps and enhanced security since the lockout began helped account for a $2.4 million jump in “other compensation” expenses in the first nine months of the year, offset partially by savings in full-time salaries, according to a Nov. 9 filing with the U.S. Securities and Exchange Commission.

“This is the last thing we wanted,” said Diana Phillips, a company spokeswoman.

Paring Workweek

The auctioneer proposed cutting the handlers’ workweek to 36 1/4 hours from 38 3/4 hours and increasing the number of temporary laborers, according to both sides. The union said new work rules would decrease eligibility for overtime, resulting in take-home pay declining 5 percent to 15 percent.

Temporary workers without medical or pension benefits would replace unionized art handlers as they retire or find other jobs, the union said.

“The people who leave would not be harmed, but the new jobs would be throwaway jobs,” said Jason Ide, the president of Local 814.

Sotheby’s says the change in work rules won’t eventually result in handlers being all non-union. The two sides have continued to negotiate, including a 4-hour session on Dec. 12.

Rowdy art handlers — who have been locked out of Sotheby’s over a labor dispute since the summer — blew whistles and shouted insults at the crowds who poured into Sotheby’s Upper East Side auction house on Wednesday night for its auction of Impressionist and modern art. But for all the anger outside the building, inside there was excitement and a great deal of relief as an international crowd of collectors and dealers watched the auction market come back to life.

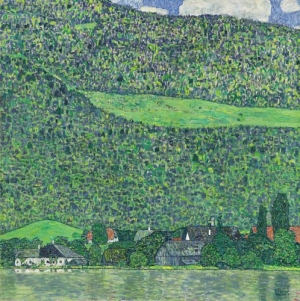

It has been a week of quick reversals and stark contrasts. On Tuesday night, the Christie’s sale of Impressionist and modern art performed poorly, making Sotheby’s sale seem like a triumph by comparison as paintings by Klimt and Caillebotte, Monet and Giacometti brought prices that far exceeded expectations.

Coming in second had its advantages. Looking at the competition’s results, Sotheby’s experts were able to gauge the market and persuade consignors to lower their reserves (the secret minimums generally agreed upon by the auction house and the seller). Sotheby’s sale was also filled with fresher material that was more conservatively estimated. And collectors responded. The sale totaled $199.8 million, right in the middle of its $167.5 million to $229.8 million estimate. Of the 70 works on offer, only 13 failed to sell. (Christie’s sale on Tuesday night brought in $140.7 million, far below its $211.9 million low estimate, and ended with 31 out of 82 works unsold.)

The evening’s star work was “Litzlberg on the Attersee,” a colorful Klimt landscape painted around 1914-15 that made $40.4 million. It had been hanging in the Museum der Moderne in Salzburg, Austria, before being returned to George Jorisch, a retired camera store manager from Montreal whose great-uncle and great-aunt had owned it before it was seized during World War II.

The painting was expected to sell for around $25 million, but five people ended up competing for it. Eventually it came down to one telephone bidder against David Lachenmann, a Zurich dealer, who won the painting.

Auction house Sotheby's missed earnings expectations when it posted a loss of $29.7 million, or -$0.44 a share, after the bell today. Consensus was for a loss of $0.35 a share.

Total revenue declined 4% to $52.9 million, as single-owner sales declined by $13.8 million.

The third quarter typically represents only 7 to 10% of annual sales, so losses for the period are generally priced in.

“Sotheby’s continues to enjoy fierce bidding for great works of art,” CEO Bill Ruprecht said. “Consolidated sales for the first nine months are up 36% to $3.8 billion and against a backdrop of global economic volatility, our Impressionist sales last week brought $229.7 million. There is vibrant demand for works of art which are fresh to the marketplace and appropriately priced.”

Faced with a class-action suit over artists’ royalties that potentially would expose them to a huge cash verdict, Christie’s and Sotheby’s likely will challenge the constitutionality of the California law on which the claim is based.

The suit in U.S. District Court in Los Angeles contends that the two big auction houses have ignored their obligation to ensure that 5% of what a seller receives should go to the artist or the artist’s heirs. The law applies to all profitable sales of more than $1,000 — if the works are by American or California-based artists and the seller is a California resident or the sale takes place in California. The royalty siphons $250 from the proceeds of a $5,000 sale and $250,000 from a $5-million sale.

“We have meaningful defenses,” Sotheby’s said in a statement Wednesday, while Christie’s said, “it views the California Resale Royalties Act as subject to serious legal challenges” and “looks forward” to making its case in court.

The courts have been down this path once before.

Eric George, attorney for plaintiffs who include artists Chuck Close and Laddie John Dill and the estate of Robert Graham, said it’s unlikely Sotheby’s and Christie’s can argue successfully that the law is unconstitutional, since there’s a legal precedent to the contrary.

Soon after the California royalty rule went into effect in 1977, a Los Angeles art dealer, Howard Morseburg, filed a test case with the support of other art dealers, contending that “the state has no business interfering” in art sales. A trial judge and the 9th U.S. Circuit Court of Appeals found otherwise, and in 1980 the U.S. Supreme Court refused to take up Morseburg’s appeal.

But some legal minds aren’t so sure that the Morseburg precedent matters anymore. Because he sued in 1977, his contention that the California law was an unconstitutional intrusion on the federal government's prerogative of making copyright law had to be weighed against provisions of the federal Copyright Act of 1909. The courts found no conflict. But the ground rules may have changed in 1978, when the Copyright Act of 1976 took effect. Writing in 1980 in the Boston College International & Comparative Law Review, Carole M. Vickers noted that the new federal copyright law specifically says that it stands “exclusively” as the law of the land on all copyright-related matters, and that “the statutes of any state” are not valid.

Vickers wrote that the California law “arguably … conflicts” with the federal copyright law, and a 1995 article by Michael B. Reddy in Loyola Marymount University’s Loyola of Los Angeles Entertainment Law Review says that “because of the unambiguous language found in both the legislative history and the text of the Copyright Act of 1976, there are serious doubts” about whether a constitutional challenge to the California resale royalty law would fail again.

Lucian Freud and Alberto Burri paintings sold for $5 million each in London last night at a Sotheby’s auction overshadowed by concern about market weakness and a protest by U.S. art handlers over a labor dispute.

Bidders had to pass a group of 20 chanting and whistling demonstrators, including three who had flown from New York and promised more action. While the contemporary and 20th-century Italian sale set six artist records and raised 40 million pounds ($63 million), the top presale estimate at hammer prices was 48.3 million pounds. Some paintings went unsold, such as Peter Doig’s “Bellevarde,” valued at as much as 2 million pounds.

“That would have sold a year ago,” the London-based dealer Edmondo di Robilant said. “The mood has changed. Auction houses entice things with high estimates and in the past they’ve been able to sell them. That wasn’t always the case tonight. A number of lots that sold were knocked down against lowered reserves.”

Dealers said economic worries were weighing on some buyers. Even headline-grabbing pieces such as Marc Quinn’s 18-carat gold sculpture of Kate Moss in a yoga pose attracted just one bid. The 2008 “Microcosmos (SIREN)” was knocked down to a bidder represented by Patti Wong of Sotheby’s Asia for 577,250 pounds.

There was also just one telephone bid for the 1952 close-up portrait “Boy’s Head” by Freud, who died in July, aged 88. It was valued at 3 million pounds and fetched 3.2 million pounds.

With buyers spoiled for choice by the $500 million of art on sale in the U.K. this week, 23 percent of the contemporary lots went unsold. The preceding Italian component was more enthusiastically received.

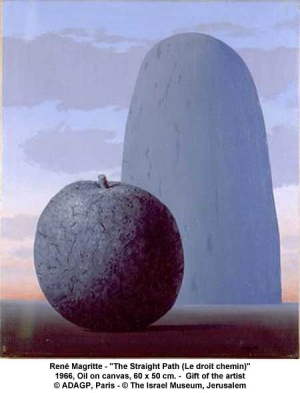

The Israel Museum will put up for sale 38 rare artworks, with an estimated value of $17 million. The museum plans to use the proceeds to upgrade its collection. Sotheby's will sell the artworks in a series of auctions, beginning on November 2, 2011, in New York, and ending in February 2012 in London.

The art up for sale includes "Le droit chemin" oil by surrealist Rene Magritte, estimated at $2.5-3.5 million; works by Camille Pissarro and Marc Chagall, estimated at $1.5-2.5 million per painting; and works by Chaïm Soutine, Pablo Picasso, and other important artists.

This is an extraordinary event that will likely echo through the international market. Museums rarely sell pieces from their collections. The Israel Museum's decision highlights the difficulties in improving their collections through donations and acquisitions budgets. Reasons for this situation include the economic crisis since 2008, which has caused donors to reduce large donations to the arts. Even before the crisis, especially in the preceding decade, soaring prices for top works of art made it difficult for museums to buy works of art.

The Israel Museum has set up an acquisitions team to help it create an organized system of acquisitions, but the process is quite complicated. Sometimes, there is competition for newly recognized important works art, and not just for already valuable pieces. Museums, which always have budget constraints, are struggling. For example, reports claim that New York's MOMA has bought the important piece "The Clock" by Christian Marclay, currently on display at the Israel Museum in its first display in a leading museum.

Pablo Picasso’s 1967 painting “L’Aubade” could fetch as much as $25 million at Sotheby’s in New York next month.

That would set an auction record for the artist’s late phase and mark a substantial rise from the work’s previous auction price of less than $100,000.

The mainly black-and-white painting depicts a gaunt naked man playing a flute for a nude woman reclining nearby and looking directly at the viewer. The figures are set against a pale-blue background and the man’s toes, ribs and hair are graphically outlined. The almond-eyed female was inspired by Picasso’s second wife, Jacqueline Roque.

The work will be auctioned Nov. 2 as part of Sotheby’s Impressionist and Modern art sale, which also includes consignments from the Israel Museum, the Menil Collection and the Museum of Fine Arts, Boston. The evening’s star by pre-sale estimate is Gustav Klimt’s “Litzlberg am Attersee,” expected to bring more than $25 million.

The Picasso painting once belonged to Sydney Barlow, a California-based collector who founded the Gibraltar Savings & Loan Association and helped set up the Los Angeles County Museum of Art, Sotheby’s (BID) said. It last appeared at auction in 1979, fetching 49,000 pounds ($75,401) at Sotheby’s in London.

The spread between that sale and the work’s current estimate range ($18 million to $25 million) illustrates a steep price acceleration of the works Picasso (1881-1973) made during his prolific last decade.

For years dismissed by critics as inferior and garish, they have recently been embraced by the art market. Auction prices increased threefold from 2003 to 2010. A 2009 Gagosian Gallery exhibition stoked the market by bringing together more than 90 works from the period.

Eight days after global equity markets lost $3.5 trillion in a week, Sotheby’s (BID) begins a Hong Kong sale of wine, art and jewels that will test the strength of China’s growing market for luxury goods.

It takes 12 catalogs weighing a total of 30 pounds (13.6 kilograms) to detail the 3,400 lots of Qing porcelain, Chateau Lafite wines, Chinese art and jade necklaces that New York-based Sotheby’s forecasts will help draw more than HK$2.7 billion ($347 million). Stocks have increased on hopes for a euro-region rescue fund, and the volatility won’t put off wealthy bidders from China, according to art dealers such as Stuart Marchant.

“The market is very strong,” said Marchant, a London- based dealer of fine Chinese porcelain who bought three pieces at Sotheby’s April sale in Hong Kong. “There are probably going to be a lot of mainland buyers.”

The six-day sale, featuring four private collections and an auction of the Rothschild family’s Bordeaux wines shipped straight from the Lafite cellars, comes as global equities and commodities are poised for their worst quarterly losses since 2008 amid concern Greece will default on its debt, tipping the world economy into a recession.

Sotheby’s autumn sale, including watches, jewelry and traditional Chinese paintings, has 200 fewer lots than its April auction in the city, which took a record HK$3.49 billion, compared with an estimate of HK$2.7 billion, the auction house said. The star lot in the spring sale, an 18th Century Chinese vase worth more than $23 million, failed to find a buyer.

Lafite Imperials

The latest series starts on Oct. 1 with rare wines, including six-liter Imperials of Chateau Lafite Rothschild from 2000 that are expected to sell for as much as $20,000 each and three liter jeroboams of Cristal champagne from the cellars of a private American collector worth $6,000.

Domaine de la Romanee-Conti burgundy wines from 1988 costing as much as $10,000 for a standard 75 centiliter bottle will be offered the following day.

Jamie Ritchie, the head of Sotheby’s Asian wine sales, said he is keeping his fingers crossed that the auction house will achieve another sell-out auction in Hong Kong, where it hasn’t had an unsold bottle in its last 15 sales.

Debra Meiburg, a Master of Wine who attended a private tasting of Bordeaux from 2000 yesterday hosted by Sotheby’s, says demand for classic French reds remains resilient.

The American Art Fair moves to a new venue as it celebrates its fourth year and will be held November 28-December 1, 2011 at the Bohemian National Hall, 321 East 73rd Street, New York City. The gala preview on Sunday, November 27, marks the beginning of American Paintings week in New York. Inaugurated in 2008 at the National Academy of Design, the fair focuses on the grand tradition of American art established early in the 19th century and gathers more than 300 works including landscapes, portraits, still lifes, studies, and sculpture.

The Fair assembles the premier specialists in 19th and early 20th century American art. Returning exhibitors include Adelson Galleries, Alexander Gallery, Avery Galleries, Debra Force Fine Art, Gerald Peters Gallery, Godel & Co. Fine Art, Hammer Galleries, Hirschl & Adler Galleries, Menconi & Schoelkopf, Questroyal Fine Art, and Thomas Colville Fine Art. New exhibitors include Babcock Galleries, Conner - Rosenkranz, Gavin Spanierman, Jonathan Boos, John H. Surovek Gallery, and Meredith Ward Fine Art.

The Bohemian National Hall was completed in 1897 in the Renaissance Revival style and was designated a New York City Landmark in 1994. After a five-year, $45 million renovation by the Czech government, it re-opened as a Czech-American cultural center in late 2008.

Fair hours are 12 p.m. to 6 p.m. daily, and to 8 p.m. on Wednesday, November 30. Admission to the preview is by invitation; and admission from November 28-December 1 is complimentary. For details, please visit www.theamericanartfair.com.

|

|

|

|

|