|

Displaying items by tag: Christie's

Faced with a class-action suit over artists’ royalties that potentially would expose them to a huge cash verdict, Christie’s and Sotheby’s likely will challenge the constitutionality of the California law on which the claim is based.

The suit in U.S. District Court in Los Angeles contends that the two big auction houses have ignored their obligation to ensure that 5% of what a seller receives should go to the artist or the artist’s heirs. The law applies to all profitable sales of more than $1,000 — if the works are by American or California-based artists and the seller is a California resident or the sale takes place in California. The royalty siphons $250 from the proceeds of a $5,000 sale and $250,000 from a $5-million sale.

“We have meaningful defenses,” Sotheby’s said in a statement Wednesday, while Christie’s said, “it views the California Resale Royalties Act as subject to serious legal challenges” and “looks forward” to making its case in court.

The courts have been down this path once before.

Eric George, attorney for plaintiffs who include artists Chuck Close and Laddie John Dill and the estate of Robert Graham, said it’s unlikely Sotheby’s and Christie’s can argue successfully that the law is unconstitutional, since there’s a legal precedent to the contrary.

Soon after the California royalty rule went into effect in 1977, a Los Angeles art dealer, Howard Morseburg, filed a test case with the support of other art dealers, contending that “the state has no business interfering” in art sales. A trial judge and the 9th U.S. Circuit Court of Appeals found otherwise, and in 1980 the U.S. Supreme Court refused to take up Morseburg’s appeal.

But some legal minds aren’t so sure that the Morseburg precedent matters anymore. Because he sued in 1977, his contention that the California law was an unconstitutional intrusion on the federal government's prerogative of making copyright law had to be weighed against provisions of the federal Copyright Act of 1909. The courts found no conflict. But the ground rules may have changed in 1978, when the Copyright Act of 1976 took effect. Writing in 1980 in the Boston College International & Comparative Law Review, Carole M. Vickers noted that the new federal copyright law specifically says that it stands “exclusively” as the law of the land on all copyright-related matters, and that “the statutes of any state” are not valid.

Vickers wrote that the California law “arguably … conflicts” with the federal copyright law, and a 1995 article by Michael B. Reddy in Loyola Marymount University’s Loyola of Los Angeles Entertainment Law Review says that “because of the unambiguous language found in both the legislative history and the text of the Copyright Act of 1976, there are serious doubts” about whether a constitutional challenge to the California resale royalty law would fail again.

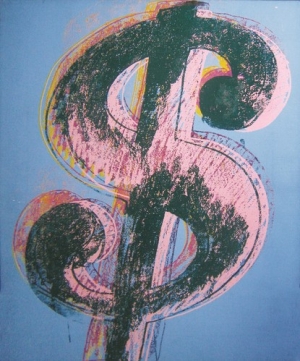

An Andy Warhol “Dollar Sign” is among artworks worth as much as $3 million being sold by Ireland’s National Asset Management Agency (NAMA) to recoup some of the debts of real-estate investor Derek Quinlan.

Christie’s International, on the instructions of NAMA, will offer 14 works from an unidentified private collection at auctions in New York and London in November, the auction house said in an e-mail. The collector was named yesterday as Quinlan by four dealers with knowledge of the matter.

Quinlan, a former tax inspector, was one of Ireland’s biggest real estate investors during the “Celtic Tiger” property boom. NAMA is an Irish government agency created to buy risky commercial loans from the country’s beleaguered banks. It took control of some of Quinlan assets in April after the investor failed to present and agree a debt repayment plan.

“These artworks were given to NAMA as security for various loans,” the agency’s spokesman, Ray Gordon, managing director of Gordon MRM media relations, said in an interview. “It has now moved to realize their value.”

The blue and pink Warhol canvas will be included in Christie’s Nov. 9 contemporary-art sale in New York with an estimate of $400,000 to $600,000. Alex Katz’s “Ace Airport” is valued at $150,000 to $200,000.

Christie’s Nov. 17 auction of 20th century British art in London will feature 11 ex-Quinlan works.

‘Still Life’

William Scott’s 1969 abstract “Still Life Variations 2” is priced at as much as 300,000 pounds ($471,000), while “Man Doing Accounts” by Jack B. Yeats -- a long-standing favorite artist with wealthy Irish collectors -- is tagged at 120,000 pounds to 180,000 pounds. The latter sold for 300,000 pounds at Christie’s in 2007. The collection’s works are estimated at as much as 1.9 million pounds.

Quinlan sold some more valuable paintings before NAMA took control of his assets, said dealers. He bought the figure-packed 1946 L.S. Lowry fairground scene “Good Friday, Daisy Nook” from the London-based dealer Richard Green, who’d paid a record 3.8 million pounds for it at Christie’s in June 2007. The work was subsequently sold for an undisclosed loss to another gallery, said dealers. Green also sold the Irish collector the Scott abstract offered by NAMA.

A telephone call to Coroin Limited, the Mayfair-based holding company for Quinlan’s Maybourne Hotel Group, produced no contact details for the Irish businessman. The Maybourne Hotel Group had no contact details.

By all accounts, Nicolas Poussin’s “Sacrament of Ordination (Christ Presenting the Keys to Saint Peter)” should have been a winner. Executed between 1636 and 1642, the painting is part of the artist’s groundbreaking series depicting the seven sacraments. It is in perfect condition and has a pristine provenance. So why was there not a single bidder interested in the painting at a Christie’s auction in London last December?

Some experts said its estimate of $24.3 million to $31 million was too high. Others said that such a specialized painting should not have gone to auction in the first place but should have been sold privately. The trustees of Belvoir Castle had put it on the market to raise money for the restoration of the castle and grounds, some 120 miles north of London.

What few people realized was that the Kimbell Art Museum in Fort Worth was quietly keeping tabs on the painting. “We were watching it closely,” said Eric M. Lee, the Kimbell’s director. “But December was not the right time for us to buy it.”

When it didn’t sell, he added, he “felt it was too important a painting to pass up.” So Mr. Lee approached the museum’s trustees “to see if we could afford it.”

This summer the institution finally made a deal, paying $24.3 million — Christie’s low estimate — without the auction house’s steep buyer’s premium. Robert Holden, a fine-art agent based in London, and George Wachter, head of Sotheby’s old master painting department worldwide, represented the Kimbell.

The painting has a particularly rich past. It is from the first set of “Seven Sacraments,” which was commissioned by the Roman collector Cassiano dal Pozzo. (A second set, painted between 1644 and 1648, was commissioned by the French collector Paul Fréart de Chantelou and belongs to the Duke of Sutherland, who has lent the paintings to the National Galleries of Scotland.)

The first series was well known among connoisseurs throughout Europe. When Sir Robert Walpole tried to buy it for his collection at Houghton Hall in England, the sale was blocked by the pope, who refused to let the paintings out of the country. But in 1785, the fourth Duke of Rutland stepped in and was able to buy them from descendants of dal Pozzo. He is said to have made copies of the paintings so the originals could be sneaked out of Italy.

Sixty contemporary artworks from the collection of computer-software developer Peter Norton are heading to the auction block at Christie’s in New York this fall.

The group, which includes pieces by Matthew Barney, Takashi Murakami and Paul McCarthy, is expected to bring in more than $25 million during the auction house’s evening and daytime contemporary-art sales in Nov. 8-9.

Norton’s interest in three-dimensional art is represented by McCarthy’s 7-foot-high “Tomato Head (Green).” Robert Gober’s 1992 “Prison Window” features a two-foot-square cutout in a wall with iron bars and blue sky in the background.

There is also Kara Walker’s sprawling 1996 frieze “African’t,” made with 25 cut-paper silhouettes, and Murakami’s cheerful sculptural mushroom ensemble, “DOB in the Strange Forest,” from 1999.

“One of my ideals for an artwork is that there are thoughts and ideas behind it, but that the work nevertheless has so much visual content that it appeals to viewers who have no understanding of those ideas,” Norton said in a statement.

Wine valued at up to $8.3 million, including a 300-bottle collection of Chateau Lafite-Rothschild spanning every year from 1981 to 2005, is scheduled for sale at Christie’s in Hong Kong this week.

The London-based house estimates the 25 cases of the Bordeaux first-growth wine, which it says have been kept in pristine condition, may fetch as much as HK$4.5 million ($575,400), or almost $2,000 per bottle. At that price, it would be the most expensive single lot of wine auctioned this year.

Demand from Asian collectors and investors has helped boost values of investment-grade vintages as wine has rebounded from losses sustained during the 2008 financial crisis. The Liv-ex 100 fine wine index has held on to the 6.8 percent gain it made in the first quarter of this year amid volatility in other markets, and is up 19.3 percent over the past 12 months.

“I’m struck each time I go to mainland China by the groundswell of demand,” Charles Curtis, Christie’s head of wine sales for Asia, said in a telephone interview from New York. “There’s nothing but upside to this trend.”

Christie’s is also offering a 3-liter jeroboam of Romanee- Conti DRC 1971 Burgundy which it says may sell for as much as HK$320,000.

A six-liter imperial of Lafite 2003 carries a high estimate of HK$100,000 while six bottles of 1911 Moet & Chandon Champagne are also being included as a single charity lot, with the potential to fetch as much as HK$500,000. The auction is taking place on Sept. 3 and Sept. 4.

Lafite Imperials

At a separate Hong Kong sale being mounted by New York- based house Zachys on Sept. 9 and Sept. 10, a collection of Lafite imperials covering the years 1995 to 2003 is up for sale, along with Chateau Mouton-Rothschild from a California collector.

Bonhams in London will feature two lots of Romanee-Conti Domaine de la Romanee-Conti Burgundy in its Sept. 8 sale. One, comprising 12 bottles of the 1990 vintage, carries an estimate of as much as 120,000 pounds ($196,500) while 12 bottles of the 1988 carry a top estimate of 80,000 pounds.

At Sotheby’s (BID) London sale on Sept. 14, Romanee-Conti and Lafite also top the bill. Two cases of Romanee-Conti 1988 DRC are on offer at a top estimate of 70,000 pounds each while two cases of Lafite are also on sale carrying a top estimate of 40,000 pounds. The auction also features Lafite 1986 and Chateau Latour 1982.

The chance to sell four paintings by the late painter Clyfford Still, whose fanatical control of his work made sales rare, has favored one of the two major auction houses and left the other angry.

The city of Denver, where the Clyfford Still Museum is opening on Nov. 18, selected Sotheby’s (BID) to place the four works through either a private sale or public auction this fall. The proceeds would benefit the museum’s endowment. The auction house guaranteed the museum more than $25 million and could earn as much as $15 million in commission.

The city rejected the offer of Christie’s International Plc, which sold a large Still canvas in 2006 for $21.3 million.

“Christie’s made a clear, detailed and timely offer to the Clyfford Still Museum and city of Denver, and want to be sure that it is given due consideration,” the company said in a statement. Christie’s hasn’t filed a formal complaint.

“It was a competitive process that was fair and followed the city’s contracting procedures,” said Jan Brennan, with the Denver office of cultural affairs and one of the nine members of the selection committee.

Still (1904-1980) was an Abstract Expressionist in his painting and crystal clear in how he wanted his works treated. He sold very little and frequently rejected exhibition opportunities. His will stipulated that the estate be given in its entirety to a U.S. city willing to establish a permanent museum housing his work alone.

Christie’s International’s first- half sales increased 15 percent to a record, boosted by auctions of contemporary works by artists such as Andy Warhol.

The London-based company was also helped by growing private sales, demand in Asia, and a 30 percent growth in the number of successful lots. It sold 2 billion pounds ($3.2 billion) of art and antiques worldwide in January through June, the most for any half-year in sterling, Christie’s said today.

“Sales have increased across a range of departments,” Steven P. Murphy, chief executive officer, said in an interview. Lots priced between 500,000 pounds and 1 million pounds were in demand, with average selling rates of more than 90 percent, he said. “While a small percentage of clients buys for investment, we’re seeing a general cultural shift toward art,” he said.

A Warhol self-portrait priced at $38.4 million was the top performer in the first half. Contemporary art fetched 431.1 million pounds, a 40 percent increase on 2010. This was more than in 2008, though not as much as in the first half of 2007.

“The contemporary market has returned,” said Murphy. “It’s done so for a wide range of names,” he said, countering perceptions that the auctions were over reliant on established postwar artists. Works by Warhol accounted for more than $90 million of sales at its New York evening auctions in May.

Sales of modern British art and prints grew by 257 percent and 73 percent respectively. London was Christie’s biggest auction center, with 607.7 million pounds of transactions.

Private Sales

While private sales rose 57 percent to 286.7 million pounds, no single auction item exceeded $40 million. Impressionist and modern-art sales declined 30 percent. Auctions in the Americas dropped 13 percent because of a shortage of collections. In May 2010, a record $106.5 million was paid in New York for a Pablo Picasso painting from the estate of Los Angeles philanthropist Frances Brody.

Hong Kong sales grew 48 percent to 296 million pounds, consolidating Asia as the third-biggest sales center. Worldwide sales of Asian art took 356.7 million pounds, up by 45 percent.

An Asian private client was the buyer of a Michelangelo drawing for 3.2 million pounds in London on July 5. Chinese buyers continue to be the largest group at international wine auctions, which increased 107 percent to 28.7 million pounds.

Works by Francis Bacon, Peter Doig and Lucian Freud helped Christie’s International raise 78.8 million pounds ($126 million) at an auction in London last night. It was the company’s highest total for a sale of contemporary works in the U.K. capital since June 2008.

The top seller was Bacon’s “Study for a Portrait,” a precursor of the Irish-born artist’s “Pope” paintings, offered by the Swiss entrepreneur and collector Donald M. Hess. The painting sold to a telephone bidder represented by Christie’s specialist Sandra Nedvetskaia, who deals with Russian clients, for 18 million pounds, against two other telephone bidders. The 1953 work was estimated at about 11 million pounds.

The above-estimate price contrasted with the failure of Bacon’s similar 1954 painting, “Man in Blue VI,” estimated at 4 million pounds to 5 million pounds, at Christie’s in February 2009 during the financial crisis.

“Bacon is back,” Offer Waterman, a London-based dealer, said. “The market is strong, though with problems like Greece, it could fall out of bed in two minutes. At the moment, there are people with plenty of cash who are investing in art as an asset class.”

Christie’s 65-lot offering had carried an estimate of 55.3 million pounds to 76.8 million pounds and was part of a series of evening sales in London that is estimated to raise as much as 195 million pounds, reflecting renewed confidence among sellers of high-value contemporary works.

While the mood in the market was lifted by dealers reporting plentiful sales in the $200,000 to $2 million-range earlier this month at the Art Basel fair in Switzerland, auctions remain the arena where international collectors are most prepared to spend multimillion sums.

Doig’s Surprise

The surprise of the evening was the 6.2 million pounds paid by another telephone bidder, represented by Christie’s U.K. chairman David Linley, for Doig’s 2003 to 2004 West Indian landscape, “Red Boat” (Imaginary Boys),” estimated at 1.4 million pounds to 1.8 million pounds.

Another telephone bidder, competing against a third-party guarantor, gave 7 million pounds for Andy Warhol’s 1973 silkscreen painting, “Mao,” a work estimated at 6 million pounds to 8 million pounds.

A 1958-1959 Freud portrait of his lover Suzy Boyt sold for 4.7 million pounds against an estimate of 3.5 million pounds to 4.5 million pounds. Entered by a descendant of the late Simon Sainsbury, “Woman Smiling” was bought by a telephone bidder.

Edward J. Dolman, chairman of Christie’s International, is leaving the auction house to join the board of the Qatar Museums Authority.

A Christie’s employee for 27 years, Dolman will be working directly for the emir’s daughter, Mayassa Bint Hamad Al Thani, as the executive director of her office, the London-based auction house said today in an e-mailed statement.

Dolman, 51, became chairman of Christie’s in September 2010, when Steven Murphy, the former president and chief executive of the U.S.-based publishing company Rodale Inc., succeeded him as CEO.

Dolman had been appointed CEO in December 1999 after spending several years as a European furniture specialist.

Qatar’s museums authority administers collections of Islamic art, Orientalist paintings, natural history, photography, armor, Islamic coins, costumes and jewelry.

In October 2010, the emir said he may be interested in acquiring the London-based auction house, the Financial Times reported, after months of speculation about a possible Qatari bid. Christie’s remains a private company owned by the French billionaire Francois Pinault. The auction house was bought by his holding company, Groupe Artemis SA, for $1.2 billion in May 1998.

Active Buyers

The new National Museum of Qatar, designed by Jean Nouvel, is scheduled to open in December 2014, according to the authority’s website. Members of the Qatari royal family have been active buyers of Western modern and contemporary art in recent years.

Operating from his gallery at Bäumleingasse in Basel, Ernst Beyeler (1921-2010) provided the world's leading collectors and museums with extraordinary art. He brought about high-power deals behind the scenes; and he organized legendary exhibitions.

Mr. Beyeler was a co-founder of Art Basel, the world's most prestigious modern and contemporary art fair. The 42nd edition of Art Basel opened with a bang in Basel this week as an international crowd pushed through the entrance to be first to the post on the invitation-only preview day (until Sunday). "You think they could wait five minutes," said one irritated fair-goer. Inside, corridors lead through a wealth of 20th- and 21st-century art with something for everybody, from billionaire collectors to those with a budget.

With his wife Hildy, Mr. Beyeler assembled a wonderful private collection of post-Impressionist, Modern, Contemporary, African and Oceanic art for which they built the Fondation Beyeler in Riehen-Basel, one of Europe's most beautiful museums.

On Tuesday and Wednesday, Christie's in London will offer works from the estate of Mr. Beyeler. They will include paintings, sculptures and drawings by notable names such as Monet, Gauguin, Renoir, Klee and Picasso. President of Christie's Europe Jussi Pylkkänen says "a tremendous atmosphere" is expected. Auction proceeds will be used to support the Fondation.

The Christie's sale will have works from the now-closed Galerie Beyeler and personal pieces that the couple loved to have around them. The latter includes an exquisite park landscape in rich watercolors from 1920 by Klee that hung above Mr. Beyeler's bedside table for more than 50 years (estimate: £400,000-£600,000).

Among the major Beyeler highlights will be one of Monet's famous "Nymphéas" series, depicting the artist's garden pond with water lilies (estimate: £17 million-£24 million). A superb portrait of Francoise Gilot by Picasso is expected to fetch £7 million-£10 million. Gilot, Picasso's lover between 1943 and 1953, was responsible for inspiring some of the artist's most joyous pictures. The portrait is intensely colored with green hair and a blue face. According to Christie's, the coloring of the picture was much influenced by Matisse, who once remarked that if he painted Gilot, she would have green hair; and a somewhat jealous Picasso decided that he would do it himself.

Meanwhile, Sotheby's on Wednesday in London is reaching for a record with Egon Schiele's "Häuser mit bunter Wäsche (Vorstadt II)" from 1914, a colorful cityscape with fantasy houses and a row of washing in the foreground. This magic painting by the Austrian artist, who died at the age of 28, is estimated at £22 million-£30 million.

|

|

|

|

|