|

Displaying items by tag: China

Fake Cultural Development Ltd., the design firm of dissident Chinese artist, Ai Wei Wei, will have its business license revoked by Chinese authorities. It is rumored that the district commercial affairs department will pull the license on the grounds that the company failed to re-register. The 55-year-old artist is a designer at the firm while his wife serves as the legal representative.

Ai Wei Wei has been under fire by the Chinese government since officials slammed him with a $2.4 million (15m yuan) tax evasion fine in 2011. His subsequent appeal was shut down in July and a Beijing court rejected his challenge to that decision last week. Ai claims that the firm was unable to properly renew their license because officials had confiscated the documents necessary to re-register during the tax evasion investigation.

Mr. Ai, China’s most famous contemporary artist, promises that the license fiasco will not affect his art. A critic of Communist Party rule, Ai Wei Wei caught the media’s attention when he was detained without explanation for nearly three months in 2011. Upon his release he was hit with the tax evasion claim and fine. Ai Wei Wei says an application has been submitted for a public hearing in regards to the revoked license.

Sotheby’s has decided to get in on China’s art market boom and has signed a 10-year-joint-venture agreement to form the first international auction house in China. Until now, international auction houses have not been permitted in China outside of Hong Kong. The agreement is with Beijing GeHua Art Company, a state-owned enterprise that is part of the Beijing GeHua Cultural Development Group. Sotheby’s will be investing $1.2 million to take an 80% stake in the undertaking.

The venture, called Sotheby’s (Beijing) Auction Co. Ltd., comes at a time when Beijing is attempting to legitimize their reputation as the auction industry has recently been burdened with rampant fakes, smuggling, and non-payments.

Sotheby’s is looking to tap into China’s growing collector base and also plans to take advantage of the new Tianzhu Free Trade Zone being developed by GeHua in Beijing. The Free Trade Zone will give Sotheby’s clients access to tax-advantage storage facilities. An inaugural auction will take place at the Millennium Hall of the Beijing World Art Museum on September 27.

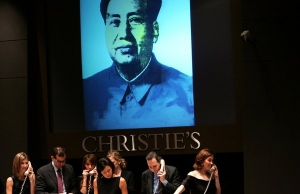

Last year, China overtook the United States to become the world’s largest art and antiques market so it’s no wonder that other companies are looking to get in on the action. For example, Christie’ International has licensed its trademark to Beijing-based auction house, Forever, although they do not hold sales in China itself. In addition, two of China’s biggest auction houses, China Guardian Auctions Co. Ltd. and Poly International, are looking to attract wealthy international clients. China Guardian opened a New York office this past December and plans to establish a strong presence in London as well.

If you pay attention either to China or the art market, you’ve probably heard the story: China last year became – according to art industry experts – the world’s largest market for art and antiques, surpassing the USA.

Well, here’s a shocker: it isn’t. Not even close.

As the global economy teeters, one market is still reaching stratospheric highs: Chinese art.

A Hong Kong auction of fine Chinese paintings earlier this month raised $94.8 million, three times pre-sale estimates. In fact, China is now the world's biggest art market, according to the art information agency Artprice.

Yet all is not what it seems in the murky world of Chinese art auctions, including a painting that sold last year for more than $11 million, but appears not to be what was advertised.

The young girl in the painting stands naked against a burgundy backdrop, one leg bent, an elbow crooked behind her back. Her eyes downcast, she looks shy and uncomfortable.

This artwork was put up to auction by Beijing Jiuge Auctions, as a portrait by the famous artist Xu Beihong of his wife, Jiang Biwei, and it sold for $11.4 million. A note from his son, Xu Boyang, on the back of the painting attests that it was by his father, although the artist died in 1953.

But Wang Yanqing, a 66-year-old painter in Inner Mongolia, tells another story.

"It's totally laughable," he says. "That picture doesn't look anything like Xu Beihong's wife." He says the picture was one of several painted by art students in his class at the prestigious Central Academy of Fine Arts (CAFA) in 1983, 30 years after the artist's death. The model was a peasant farmer. Wang was one of those students who painted her, and his memory is crystal clear.

"At that time, it was very difficult to find nude models, so we painted the same ones over and over, and it was boring," he remembers. "Suddenly this new model came — a young girl from the south who'd never modeled before, and everyone was very excited. We all wanted to draw her, so almost 20 of us crowded into the same room. It was one of my most successful pictures. I still have it in my studio."

Indeed, the subject in his painting is identical to the one that sold for $11 million, except for the angle. Four other classmates have produced pictures of the same girl, in the same pose, with the same backdrop. As Wang points out, it's an impossible coincidence.

"The person we painted had a 1980s hairstyle," he says, and he also notes the different styles of painting. "Xu Beihong studied in France, so he painted in a Western European style. But we were painting under the Soviet influence in a Russian style." He and his classmates published an open letter exposing the picture as a fake to stop it from circulating on the market.

No Standards For Auctions

"At this moment, in practice, there are no standards" in the Chinese art market, says Gong Jisui, a former Sotheby's expert who's now a visiting scholar in Beijing at CAFA.

"It's really, really bad. For the classical Chinese paintings, most of the pieces are disputable," Gong says. "Also, for modern Chinese paintings, there is a serious problem with authenticity issues."

It's not just the pieces that might be fake. At Chinese auctions, the bids are sometimes fake too. In some cases, the seller, or even the artist, may bid on their own pieces to push the prices up.

Sometimes auctions are used to pass bribes. For example, the buyer overbids for something mediocre — or even fake — and so passes money legally to the seller. Many auction houses turn a blind eye, since the higher the price, the higher their commission.

Paul Dong of Forever Auctions, the trademark licensee for Christie's in China, describes how the approach is made. "There are clients at certain times who come to us and say, 'Don't look at the quality of the property. I can assure you someone will buy it at a very high price, you'll earn your money.' We absolutely reject such offers."

LONDON, ENGLAND – By now it is no secret that newly wealthy Chinese buyers are transforming the global market for art and antiques. Sotheby’s chief executive William Ruprecht recently told the Wall Street Journal that the Chinese are spending $4 billion a year on Chinese paintings alone - more than Sotheby’s and Christie’s combined annual sales of Impressionist, modern and contemporary art. Nearly all of the leading auction houses are seeking Mandarin-fluent staff.

But despite their assertive auction presence, Chinese buyers are scarce at the West’s leading art and antiques shows, a challenge for dealers looking to groom new collectors. That may be about to change. In late September, representatives from the European Fine Art Fair (TEFAF), organized each March in the Dutch city of Maastricht, made their first visit to China.

Led by TEFAF chairman Ben Janssens, the group hosted receptions for collectors in Beijing and Shanghai and were received by officials at the splendid Shanghai Museum. In Beijing, they visited the Palace Museum at the Forbidden City, the new National Museum of China at Tiananmen Square, and the Capital Museum, which showcases the imperial city’s storied past.

The friend-raising tour was part of a global campaign to market TEFAF, regarded by some as the world’s leading venue for traditional art and antiques. TEFAF, which celebrates its 25th anniversary in 2012, is hosting an event in another BRIC country, Brazil, in late October. Between December and February, TEFAF representatives will wine and dine their way through Milan, Munich, Lisbon, Paris, Luxemburg, Amsterdam and Brussels.

AFAnews.com recently spoke to Asian art dealer Ben Janssens from his gallery on London’s Jermyn Street, where his specialties include early Chinese pottery, porcelain, bronze and jade as well as later Ming and Qing dynasty objects.

AFAnews: What prompted TEFAF’s trip to China?

BJ: Over the past three years, TEFAF has welcomed groups of Chinese collectors, albeit in fairly limited numbers. We have been thinking about doing something in China but wanted to wait until the time was right. Until now, Chinese collectors have mainly been interested in Chinese art. That is beginning to shift, so it seemed right that we should go. Interestingly, Chinese museums are also beginning to look much more to the West. The Capital Museum is hosting “Van Gogh and the Amsterdam Impressionists.” An exhibition of Bulgari jewelry and “Art of the Enlightenment” - organized by the Berlin National Museum, the Dresden National Art Collection Museum and the Bavarian State Picture Galleries - are at the National Museum.

AFAnews: Who was in the TEFAF delegation?

BJ: It was really just me and our head of marketing, Titia Vellenga. We were assisted in China by two people, TEFAF representative Xiaoling Xu, and an American, Mike Bruhn. Mike has lived in China for 20 years. He was with Sotheby’s in Hong Kong and now has his own business based in Beijing and Shanghai. He organizes events and launches for Western brands and is quite involved in marketing various museums in China. We were also joined by a TEFAF exhibitor, Mark Schaffer of A La Vieille Russie in New York, who had concurrent business in China.

AFAnews: How many Chinese collectors are visiting TEFAF?

BJ: They mostly come in groups although a few Chinese collectors travel individually. We recently had a collecting circle from Nanjing and another from Shanghai. The visits are well organized. We help with travel planning and translators to make it easier for them. Many Chinese would like to visit the fair but the logistics are difficult. We have offered similar assistance for many years to groups all over the world.

AFAnews: Did TEFAF reach out to institutions or individuals?

BJ: The mission was really to target as many private collectors as possible. In Beijing, we hosted a reception and dinner for about fifty collectors at the residence of the Dutch ambassador. Some institutions were represented, as well. We approached our visit to Shanghai quite differently. We had a presentation at the Chinese Collectors Club, which limits its numbers. We tried to give them an impression of what the fair was like through an audio-visual presentation. Altogether, we met 120 collectors in Beijing and Shanghai. Many expressed their interest in coming to TEFAF Maastricht.

AFAnews: I understand that the group was hungry for facts and figures.

BJ: That’s typical for Chinese audiences. I was prepared for it. Some questions we can answer, such as what percent of our exhibitors are Asian art specialists (about ten percent). There are many things we can’t easily answer, such as what the sales turnover is at TEFAF.

AFAnews: Was the trip a success?

BJ: There is huge interest in the fair. We noticed that TEFAF is very much recognized as a brand and Chinese collectors do see us as such. There was some curiosity about whether we might mount a TEFAF fair in China.

AFAnews: Will you?

BJ: You never know. The idea would require much more exploration to make sure that it was the right step.

AFAnews: Does TEFAF host similar events in other parts of the world?

BJ: We adapt the formula to where we are. In most cases, invitations are extended by participants in our fair. So far we have had only one exhibitor from China, Meg Maggio of Pekin Fine Arts. She was in our Showcase. We have done events in South America and in European countries where there is not widespread awareness of TEFAF. We haven’t yet visited Russia or the Middle East.

AFAnews: Will TEFAF change to reflect the increasingly global nature of the art market?

BJ: I think it already has. Five years ago, when I became chairman, there wasn’t much Asian art at Maastricht. Now we have a comprehensive selection, including three dealers in Japanese art. Three years ago we introduced contemporary design. We try to be as responsive as we can to the general public.

AFAnews: Many dealers have had limited success selling to Chinese collectors. Why is that?

BJ: I think it has to do with what you sell. My focus is on early Chinese art and also Ming and Qing ceramics and for that there is definitely a clientele in China. But it’s not easy. You have to go there and be responsive. The approach is very different than what we are used to in Europe. You have to wait.

AFAnews: Is language the primary obstacle?

BJ: There was a very good reason why TEFAF decided to have a Chinese language site about three years ago. It is completely in Chinese. And for most dealers, the same thing goes. I have just produced a catalog with Chinese captions for my participation in Asia Week in London in November. The auction houses got onto this very early and have had the means to develop it. They definitely got the march on dealers but dealers are catching up. The Chinese market is now one that no one can afford to ignore.

Postscript

The Chinese market is indeed one that no one is ignoring, least not the Chinese.

In a follow-up exchange with AFAnews.com, TEFAF’s marketing chief Titia Vellenga remarked on the speed with which the Chinese art market is developing.

“In 2009, China became the third largest art market globally with a market share of 14%. In 2010, it overtook the second position of the UK that dropped from 27% to 22%, whereas the Chinese art market share in 2010 was 23%,” she said.

Others are also working to facilitate more East-West exchange. The mainland auction house, China Guardian, is opening offices in New York and London this fall. According to The Art Newspaper, it seeks to repatriate consignments of Chinese art but has not ruled out selling Western art, as well. And Hong Kong dealer Andy Hei hosted the seventh edition of Fine Art Asia from October 3-7 at the Hong Kong Convention Center. The fair, whose stated aim is to be “Asia’s Maastricht,” coincides with the Asian capital’s fall auctions. Among its ninety-plus exhibitors are Apter-Fredericks Ltd., a founding partner of London’s Masterpiece fair and his colleagues Berwald Oriental Art, M.D. Flacks, Michael Goedhuis, Geoffrey Diner Gallery, Nicholas Grindley and Carlton Hobbs. Unlike TEFAF, Fine Art Asia is unvetted.

Write to Laura Beach at This email address is being protected from spambots. You need JavaScript enabled to view it.

LONDON, ENGLAND – By now it is no secret that newly wealthy Chinese buyers are transforming the global market for art and antiques. Sotheby’s chief executive William Ruprecht recently told the Wall Street Journal that the Chinese are spending $4 billion a year on Chinese paintings alone - more than Sotheby’s and Christie’s combined annual sales of Impressionist, modern and contemporary art. Nearly all of the leading auction houses are seeking Mandarin-fluent staff.

But despite their assertive auction presence, Chinese buyers are scarce at the West’s leading art and antiques shows, a challenge for dealers looking to groom new collectors. That may be about to change. In late September, representatives from the European Fine Art Fair (TEFAF), organized each March in the Dutch city of Maastricht, made their first visit to China.

Led by TEFAF chairman Ben Janssens, the group hosted receptions for collectors in Beijing and Shanghai and were received by officials at the splendid Shanghai Museum. In Beijing, they visited the Palace Museum at the Forbidden City, the new National Museum of China at Tiananmen Square, and the Capital Museum, which showcases the imperial city’s storied past.

The friend-raising tour was part of a global campaign to market TEFAF, regarded by some as the world’s leading venue for traditional art and antiques. TEFAF, which celebrates its 25th anniversary in 2012, is hosting an event in another BRIC country, Brazil, in late October. Between December and February, TEFAF representatives will wine and dine their way through Milan, Munich, Lisbon, Paris, Luxemburg, Amsterdam and Brussels.

AFAnews.com recently spoke to Asian art dealer Ben Janssens from his gallery on London’s Jermyn Street, where his specialties include early Chinese pottery, porcelain, bronze and jade as well as later Ming and Qing dynasty objects.

AFAnews: What prompted TEFAF’s trip to China?

BJ: Over the past three years, TEFAF has welcomed groups of Chinese collectors, albeit in fairly limited numbers. We have been thinking about doing something in China but wanted to wait until the time was right. Until now, Chinese collectors have mainly been interested in Chinese art. That is beginning to shift, so it seemed right that we should go. Interestingly, Chinese museums are also beginning to look much more to the West. The Capital Museum is hosting “Van Gogh and the Amsterdam Impressionists.” An exhibition of Bulgari jewelry and “Art of the Enlightenment” - organized by the Berlin National Museum, the Dresden National Art Collection Museum and the Bavarian State Picture Galleries - are at the National Museum.

AFAnews: Who was in the TEFAF delegation?

BJ: It was really just me and our head of marketing, Titia Vellenga. We were assisted in China by two people, TEFAF representative Xiaoling Xu, and an American, Mike Bruhn. Mike has lived in China for 20 years. He was with Sotheby’s in Hong Kong and now has his own business based in Beijing and Shanghai. He organizes events and launches for Western brands and is quite involved in marketing various museums in China. We were also joined by a TEFAF exhibitor, Mark Schaffer of A La Vieille Russie in New York, who had concurrent business in China.

AFAnews: How many Chinese collectors are visiting TEFAF?

BJ: They mostly come in groups although a few Chinese collectors travel individually. We recently had a collecting circle from Nanjing and another from Shanghai. The visits are well organized. We help with travel planning and translators to make it easier for them. Many Chinese would like to visit the fair but the logistics are difficult. We have offered similar assistance for many years to groups all over the world.

AFAnews: Did TEFAF reach out to institutions or individuals?

BJ: The mission was really to target as many private collectors as possible. In Beijing, we hosted a reception and dinner for about fifty collectors at the residence of the Dutch ambassador. Some institutions were represented, as well. We approached our visit to Shanghai quite differently. We had a presentation at the Chinese Collectors Club, which limits its numbers. We tried to give them an impression of what the fair was like through an audio-visual presentation. Altogether, we met 120 collectors in Beijing and Shanghai. Many expressed their interest in coming to TEFAF Maastricht.

AFAnews: I understand that the group was hungry for facts and figures.

BJ: That’s typical for Chinese audiences. I was prepared for it. Some questions we can answer, such as what percent of our exhibitors are Asian art specialists (about ten percent). There are many things we can’t easily answer, such as what the sales turnover is at TEFAF.

AFAnews: Was the trip a success?

BJ: There is huge interest in the fair. We noticed that TEFAF is very much recognized as a brand and Chinese collectors do see us as such. There was some curiosity about whether we might mount a TEFAF fair in China.

AFAnews: Will you?

BJ: You never know. The idea would require much more exploration to make sure that it was the right step.

AFAnews: Does TEFAF host similar events in other parts of the world?

BJ: We adapt the formula to where we are. In most cases, invitations are extended by participants in our fair. So far we have had only one exhibitor from China, Meg Maggio of Pekin Fine Arts. She was in our Showcase. We have done events in South America and in European countries where there is not widespread awareness of TEFAF. We haven’t yet visited Russia or the Middle East.

AFAnews: Will TEFAF change to reflect the increasingly global nature of the art market?

BJ: I think it already has. Five years ago, when I became chairman, there wasn’t much Asian art at Maastricht. Now we have a comprehensive selection, including three dealers in Japanese art. Three years ago we introduced contemporary design. We try to be as responsive as we can to the general public.

AFAnews: Many dealers have had limited success selling to Chinese collectors. Why is that?

BJ: I think it has to do with what you sell. My focus is on early Chinese art and also Ming and Qing ceramics and for that there is definitely a clientele in China. But it’s not easy. You have to go there and be responsive. The approach is very different than what we are used to in Europe. You have to wait.

AFAnews: Is language the primary obstacle?

BJ: There was a very good reason why TEFAF decided to have a Chinese language site about three years ago. It is completely in Chinese. And for most dealers, the same thing goes. I have just produced a catalog with Chinese captions for my participation in Asia Week in London in November. The auction houses got onto this very early and have had the means to develop it. They definitely got the march on dealers but dealers are catching up. The Chinese market is now one that no one can afford to ignore.

Postscript

The Chinese market is indeed one that no one is ignoring, least not the Chinese.

In a follow-up exchange with AFAnews.com, TEFAF’s marketing chief Titia Vellenga remarked on the speed with which the Chinese art market is developing.

“In 2009, China became the third largest art market globally with a market share of 14%. In 2010, it overtook the second position of the UK that dropped from 27% to 22%, whereas the Chinese art market share in 2010 was 23%,” she said.

Others are also working to facilitate more East-West exchange. The mainland auction house, China Guardian, is opening offices in New York and London this fall. According to The Art Newspaper, it seeks to repatriate consignments of Chinese art but has not ruled out selling Western art, as well. And Hong Kong dealer Andy Hei hosted the seventh edition of Fine Art Asia from October 3-7 at the Hong Kong Convention Center. The fair, whose stated aim is to be “Asia’s Maastricht,” coincides with the Asian capital’s fall auctions. Among its ninety-plus exhibitors are Apter-Fredericks Ltd., a founding partner of London’s Masterpiece fair and his colleagues Berwald Oriental Art, M.D. Flacks, Michael Goedhuis, Geoffrey Diner Gallery, Nicholas Grindley and Carlton Hobbs. Unlike TEFAF, Fine Art Asia is unvetted.

Write to Laura Beach at This email address is being protected from spambots. You need JavaScript enabled to view it.

Eight days after global equity markets lost $3.5 trillion in a week, Sotheby’s (BID) begins a Hong Kong sale of wine, art and jewels that will test the strength of China’s growing market for luxury goods.

It takes 12 catalogs weighing a total of 30 pounds (13.6 kilograms) to detail the 3,400 lots of Qing porcelain, Chateau Lafite wines, Chinese art and jade necklaces that New York-based Sotheby’s forecasts will help draw more than HK$2.7 billion ($347 million). Stocks have increased on hopes for a euro-region rescue fund, and the volatility won’t put off wealthy bidders from China, according to art dealers such as Stuart Marchant.

“The market is very strong,” said Marchant, a London- based dealer of fine Chinese porcelain who bought three pieces at Sotheby’s April sale in Hong Kong. “There are probably going to be a lot of mainland buyers.”

The six-day sale, featuring four private collections and an auction of the Rothschild family’s Bordeaux wines shipped straight from the Lafite cellars, comes as global equities and commodities are poised for their worst quarterly losses since 2008 amid concern Greece will default on its debt, tipping the world economy into a recession.

Sotheby’s autumn sale, including watches, jewelry and traditional Chinese paintings, has 200 fewer lots than its April auction in the city, which took a record HK$3.49 billion, compared with an estimate of HK$2.7 billion, the auction house said. The star lot in the spring sale, an 18th Century Chinese vase worth more than $23 million, failed to find a buyer.

Lafite Imperials

The latest series starts on Oct. 1 with rare wines, including six-liter Imperials of Chateau Lafite Rothschild from 2000 that are expected to sell for as much as $20,000 each and three liter jeroboams of Cristal champagne from the cellars of a private American collector worth $6,000.

Domaine de la Romanee-Conti burgundy wines from 1988 costing as much as $10,000 for a standard 75 centiliter bottle will be offered the following day.

Jamie Ritchie, the head of Sotheby’s Asian wine sales, said he is keeping his fingers crossed that the auction house will achieve another sell-out auction in Hong Kong, where it hasn’t had an unsold bottle in its last 15 sales.

Debra Meiburg, a Master of Wine who attended a private tasting of Bordeaux from 2000 yesterday hosted by Sotheby’s, says demand for classic French reds remains resilient.

As auction houses prepare for their fall sales, Chinese collectors are expected to be a major boost for the market, raising their paddles for big-ticket artworks despite a backdrop of global economic turmoil.

With China’s economy booming, art collectors there have become an increasingly powerful force in the market, demonstrating a growing interest in Western as well as Asian art.

At Sotheby’s spring sale, a Chinese buyer bought the evening’s priciest painting — Picasso’s “Femme Lisant (Deux Personnages)” — for $21.3 million. In March, at the auction house Lebarbe, in Toulouse, France, a Chinese buyer set a new French record for Chinese art with a $31 million bid on a scroll painting from the Imperial Palace in Beijing. Last year an anonymous telephone bidder who was believed to be Chinese paid $106.5 million for Picasso’s “Nude, Green Leaves and Bust” at Christie’s, a record for a work of art at auction.

Chinese auction houses are now selling works at a pace formerly associated with those in London and New York. One company that tracks the fine-art market, Artprice, reported that they were responsible for some $8.3 billion in sales, which would make them the world leader.

“We have seen exponential growth by mainland Chinese buyers who were brought up during the Cultural Revolution,” said Henry Howard-Sneyd, Sotheby’s vice chairman for Asian art. “These are successful business people with huge amounts of money at their disposal.”

The auction market is responding to the new demand. Last year Sotheby’s held its first exhibition for the private sale of art specifically for the Asian market. It featured Picassos, Monets and Chagalls that sold for $2 million to $25 million.

This year Christie’s appointed Chinese representatives in both New York and London to develop new clients in Asia and manage relations with Christie’s most important private collectors from mainland China and Asia.

“Chinese buyers are now recognized in the art world and auction world as the most important area of business development,” said Lawrence Chu, a collector based in Hong Kong who runs BlackPine Private Equity Partners.

The current Chinese influx is fueled by the sort of new wealth that has made the country home to the world’s largest number of billionaires, according to the Hurun Rich List 2010, China’s version of the Forbes 400. The number of Chinese billionaires is expected to increase 20 percent each year through 2014, according to Artprice.

To some extent, auction experts say, the Chinese regard art not only as a sound way to diversify their portfolios but also as a tested means to project status as they interact with international business executives — “the Arnaults and the Pinaults of the world,” said François Curiel, the president of Christie’s Asia, referring to the French billionaires Bernard Arnault and François Pinault.

Anish Kapoor has cancelled plans to present his sculptures at the National Museum of China in Beijing, in protest against the continuing detention of Ai Weiwei. He had been asked by the British Council to consider a show at the newly renovated museum in Tiananmen Square as part the “UK Now” festival in China late next year.

Kapoor’s spokeswoman confirmed to The Art Newspaper that he had been invited to China, but “he is not going to proceed in view of the detention of Ai Weiwei.” Ai, an outspoken critic of the Chinese government, was arrested in Beijing in early April for alleged “economic crimes”.

Discussions began about a potential exhibition at the National Museum of China last October, when two directors of London’s Lisson Gallery (which represents Kapoor, stand 2.1/K12 at Art Basel) were in Beijing. Provisional plans were subsequently made for Kapoor to travel to Beijing this month to view the space and talk with the museum. The idea would have been to mount an exhibition with a major new work.

Zhan Wang’s monumental Artificial Rock No. 43 stands like the rocky mountain it represents under the tall spine of Calatrava’s Quadracci Pavilion at the Milwaukee Art Musuem. Wang hammered sheets of steel over two boulders to get their natural shapes, then polished the stainless steel to a gleaming sheen. The reflective surface picks up the colors and moods of Lake Michigan, which lies just beyond the windows.

Wang is a contemporary Chinese sculptor. His steel Artificial Mountain Rocks were the first Chinese contemporary sculptures acquired by the Metropolitan Museum of Art in New York and the De Young Museum in San Francisco, according to Art Speak China.

Rock 43 is the first thing you see of MAM’s sprawling exhibition of Chinese art, which opens Saturday, June 11. The sculpture is in wonderful dialog with The Emperor’s Private Paradise - Treasures from the Forbidden City, the wondrous exhibition of artworks made for the Qianlong emperor in the 18th century.

We enter the Emperor’s Private Paradise through the tall Gateway of the Forbidden City’s Second Courtyard, a rockery. China harbors a long tradition of rock gardens, with sophisticated aesthetics governing the selection, placement and manipulation of rocks. Wang’s Artificial Rock No. 43 addresses this tradition with rockery that Aneesh Kapour could understand, according to Brady Roberts, the Milwaukee Art Museum’s Chief Curator. Roberts chose Wang’s rock to illustrate the contemporary Chinese artists’ deep connection with the past combined with an equally deep understanding of the present art world dialog.

I was fortunate to walk through the Emperor’s Private Paradise exhibition with the elegant Nancy Berliner, Curator of Chinese Art at the Peabody Essex Museum and author of the show’s catalog, and with Laurie Winters, MAM’s Senior Curator and Director of Exhibitions.

Berliner spoke of one large, craggy rock that is visiting Milwaukee. Jagged edges represent the tranquility and longevity of mountains, the ideal place for scholars’ meditations. This specimen is about three feet tall and set on a pedestal. Berliner noted that some rockeries in the Forbidden Garden are over two stories tall. The rockeries in the garden comprise Lingbi rocks, chosen for three qualities: penetrability (see into an opening), wrinkling (faceted surface) and “awkwardness.” Berliner described them as “anti-aesthetic” and purposely not meant for that “childish appreciation” of something merely pretty. She likened it to the anti-aesthetic of Abstract Expressionism, pointing out the rock’s surface “wrinkled like a de Kooning sculpture.”

I was reminded of the artist John Baldassari’s quote: “Art is a conversation. You say something. Then I say something.” That art conversation can occur among contemporaries or across centuries.

A large portrait of the Qianlong emperor hangs near the rockery. This portrait appears at first to be a very traditional Chinese painting on silk, with the emperor’s dragon symbols and imperial yellow. But something is different. The face is modeled with delicate shadows and the patterned carpet recedes in perfect linear perspective. Berliner explained that the emperor was very interested in western art and culture. Jesuit missionary artists taught the Chinese perspective and illusion of form. As we walked through this collection of more than 90 objects from the Qianlong Garden, she pointed out over and over the instances of Western influence within the Chinese murals, screens, furniture, jades and cloisonné.

|

|

|

|

|