|

Displaying items by tag: buyer's premium

A wooden Le Corbusier statue of a woman sold for 3.1 million francs ($3.3 million) at Christie’s in Zurich, setting an auction record for the Swiss artist.

“Femme,” a 6-foot-tall mahogany sculpture with red and white painted elements, was created by modernist architect Le Corbusier in 1962. The price, which includes a buyer’s premium, beats Le Corbusier’s previous record of 1 million pounds ($1.5 million), according to Hans-Peter Keller, head of Swiss art at Christie’s.

The $1.36 billion auction week of postwar and contemporary evening sales in New York had its low-key finale at Phillips on Thursday, turning in a solid though hardly exceptional $51,964,750. The decent tally fell close to midway between pre-sale expectations of $45,760,000-67,790,000 million, though estimates do not include the buyer’s premium pegged at 25 percent up to an including $100,000, 20 percent up to and including $2 million, and 12 percent for anything above that.

Eight of the 47 lots offered failed to sell for a workmanlike 17 percent buy-in rate by lot.

The Henry Graves Jr. Supercomplication, has sold at Sotheby’s, Geneva, for a record-breaking $24 million (which includes the buyer’s premium).

With 24 complications, it has previously been styled as the most famous watch in the world, but it comes with a very human story attached and illustrates how the Swiss watch industry worked in the early 20th century.

The watch is the result of a competition between two phenomenally wealthy men: Henry Graves, a New York banker, and James Ward Packard, a car manufacturer from Warren, Ohio.

A mystery worthy of the one of the great writer’s own books reached its conclusion in Bonhams Jewelery sale in Knightsbridge.

Setting the room buzzing with excitement, bidders in the room, on the telephones, and online competed for Christie’s diamond brooch and three-stone diamond ring, pushing the prices ever higher. The ring, originally estimated at £3,000-5,000, sold for £21,875 (including buyer’s premium), and the brooch, estimated at £6,000-8,000, sold for a whopping £27,500 (including buyer’s premium).

The two pieces were long thought to be lost, having been mentioned as family heirlooms by Christie in her autobiography, but their whereabouts were unknown.

According to The Art Newspaper, Christie’s has boosted its seller’s commission in its contracts with consignors. The auction house will now charge 2% of the hammer price of a work that meets or exceeds its high estimate. After the 2% performance fee, Christie’s charges commission using a sliding scale based on a work’s final hammer price.

In order to attract powerful sellers offering blue-chip works, auction houses often waive the seller’s commission for preferred clients. Christie’s new 2% performance fee, which is in addition to the fixed buyer’s premium (the percentage of the hammer price paid by the buyer), ensures that the auction house will receive a portion of the profits from both sides of a blockbuster sale.

A piece of French history was acquired by Paris’s Musée des Lettres et Manuscrits this weekend. On Sunday, 21 September, the museum bought Napoleon Bonaparte and Josephine Beauharnais’s marriage contract for €437,500 at auction, including buyer’s premium. The sale was held by Osenat, the Fontainebleau-based specialist in Napoleonic memorabilia, in the grounds of the Chateau de Malmaison, Josephine’s favourite retreat a few miles west of Paris.

Dated 9 March 1796, the four-page document was signed by the couple the day before their nuptials.

Christie’s announced that its Buyer’s Premium will be an amount equal to 25% of the hammer price of each lot up to and including $100,000; 20% of the hammer price from $100,001 up to and including $2,000,000; and 12% of any sales above $2,000,001. Christie’s previously charged 25% of the hammer price up to and including $75,000; 20% on the amount from $75,001 to $1.5 million; and 12% on anything exceeding $1.5 million.

This is the second time that Christie’s has adjusted its Buyer’s Premium, a fee charged to buyers at auction, this year. Prior to the initial change, which went into effect on March 11, 2013, Christie’s Buyer’s Premium had been unchanged since 2008.

On November 4, 2013, Christie’s will auction works from the private collection of the prominent art dealer Jan Kruiger. The sale, which will take place five year’s after Kruiger’s death, is expected to garner over $160 million. A consequent sale of works on paper and sculpture will likely bring around $15 million.

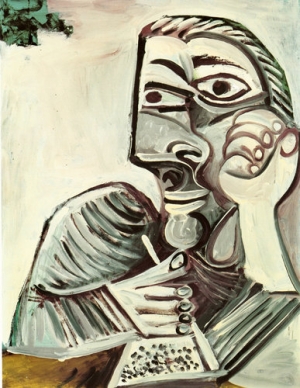

The sale at Christie’s will present a mere fraction of Kruiger’s personal collection. The remainder has either been sold privately or resides with his family. Highlights from the upcoming auction include Wassily Kandinsky’s landscape Herbstlandschaft, which carries an estimate of $6 million to $8 million, and Pablo Picasso’s sheet-iron sculpture Tete (Head), which is expected to fetch $25 million to $35 million.

While Christie’s and Sotheby’s were in close competition to helm the sale, Christie’s allegedly offered a more profitable financial package to Kruiger’s heirs, giving them a more significant percentage of the buyer’s premium.

Kruiger opened the Jan Kruiger Gallery of New York, which specialized in 19th century, 20th century and contemporary art, in 1967. It remained a fixture of the art world for decades.

Sotheby’s announced its financial results for the first quarter of 2013, which ended March 31. The auction house’s first quarter total revenues were $101.7 million, a $3.2 million decrease from 2012. The decline was mainly caused by a reduction in auction commission margin from 18.1% to 15%. However, the quarter’s net auction sales increased 23% compared to last year’s first quarter.

High-grossing categories, including Impressionism as well a Modern and Contemporary Art, remained highly competitive. In an effort to enhance revenue and strengthen auction commission margins, Sotheby’s changed its buyer’s premiums structure rate on March 15, 2013. Buyers now pay 25% on the first $100,000 of a work’s selling price; 20% on the portion of the price above $100,000 but under $2 million; and 12% on any remaining amount about $2 million. Since most sales for the first quarter of 2013 took place before this shift occurred, it did not have a substantial impact on Sotheby’s results for the first quarter of 2013.

Due to the nature of the auction seasons, first and third quarters tend to bring in lower revenues than the second and fourth quarters. Typically, first quarter results are not an accurate gauge of expected full year results. Sotheby’s Chairman, President and CEO Bill Ruprecht said, “The first quarter showed a solid increase in auction sales compared to the prior year, but the results illustrate how competitive the market is for the highest value consignments. That competition resulted in lower commission margins, which is reflected on the bottom line.”

Two weeks after Christie’s announced that they will be increasing their buyer’s premium, a fee charged to buyers, Sotheby’s revealed that they will raise their commissions as well. It is the first time Sotheby’s has boosted its buyer’s premium since 2008.

Sotheby’s and Christie’s had both been charging 25% for the first $50,000 of a sale, 20% on the amount from $50,000 to $1 million and 12% on the remainder. Sotheby’s new fees will take 25% of the first $100,000 of a purchase, 20% from $100,000 to $1.9 million, and 12% of the rest. While both auction houses are raising commissions, it will be slightly cheaper for patrons to buy at Christie’s as their new fees charge 25% for the first $75,000 of a purchase, 20% on the amount from $75,001 to $1.5 million, and 12% on whatever is left.

Sotheby’s announced the hike on Thursday, February 28, 2013, the same day that the auction house reported a decline in both revenues and profits for 2012. Sotheby’s revenues for the year were $768.5 million, an 8% decrease from the year before. The auction house attributes the decline to a reduction in commissions. In recent years Sotheby’s has given a percentage of the buyer’s premiums to its biggest sellers as an incentive to maintain their business, a practice that also cuts into the auction house’s profits.

|

|

|

|

|