|

Displaying items by tag: Auction

Artists and collectors looking to cash in on the reported one percent's run on the international art market can take cues from a recent Washington State University study on auction house sales of paintings by Picasso, Magritte, Munch, and a dozen other impressionist and modern masters. Among the preliminary findings, a single percentage point increase in Google hits on the artist—the assigned indicator of popularity—corresponded to a chunky price increase of 38 percent.

A 1930s Mercedes (DAI) may sell for more than $16 million in California this month as classic-car auctioneers test the market with an unprecedented lineup of big- ticket autos by names such as Ferrari, Bugatti and Bentley.

The Mercedes-Benz 540 K Special Roadster is one of only 30 built. It may exceed an auction record of $16.4 million, set by a Ferrari last year, and comfortably beat the price of a Ferrari 250 GT California Spyder convertible, one of three included in the series of sales, which is estimated at $9 million.

As the world economy began to tank about five years ago, a curious thing happened at the top level of the international art market: It started to boom. At the annual spring art auctions at Sotheby's and Christie's in New York and their branches around the globe, deep-pocketed bidders snapped up Braques and Bacons, Klimts and Kandinskys, often at record prices.

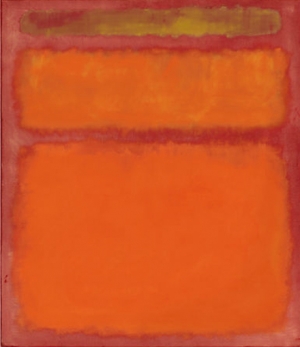

Now with the global recession officially over but the American and European economies still shaky, auction records for blue-chip modern and contemporary art continue to be shattered. Just a few months ago, a pastel version of Edvard Munch’s "The Scream" (1895) fetched an astounding $119.9 million at Sotheby’s, by far the highest price ever paid at auction for a work of art, surpassing the winning bid of $106.5 million for Picasso's "Nude, Green Leaves and Bust" (1932) at Christie’s two years earlier. A week after the gavel fell on the Munch, Mark Rothko's "Orange, Red, Yellow" (1961) went for nearly $87 million, the artist’s personal best at auction.

Roy Lichtenstein’s “Sleeping Girl” sold for $44.9 million at Sotheby’s in New York last night, a record for the artist, in a $266.6 million contemporary-art auction that was almost a third smaller by value than Christie’s the night before.

Records were also set for Ai Weiwei, Cy Twombly, Glenn Ligon, Mark Bradford and Isa Genzken, as 11 of the 57 lots didn’t sell.

The casualties included two paintings by Willem de Kooning, who had a recent retrospective at the Museum of Modern Art, and a photograph by Cindy Sherman, who has a solo show there now.

“It seems like there’s a lot of money chasing the trophies, but the rest of the market is tepid,” said Suzanne Gyorgy, global head of art advisory and finance at Citi Private Bank. (C) “It felt shaky.”

The night before, Christie’s achieved records for Jackson Pollock, Gerhard Richter and Alexander Calder in the biggest- ever contemporary-art auction. Just three of 59 lots failed to sell.

“Maybe people were spent out,” said Joanne Heyler, director and chief curator of the Broad Art Foundation, established by collector Eli Broad. “There wasn’t the same density of high-value lots. The market hasn’t completely lost its head.”

Dealers said Sotheby’s estimates were optimistic for a cache that was less spectacular than Christie’s, which had 13 lots from the estate of collector David Pincus that alone totaled about $175 million.

‘Freshness and Provenance’

“At the end of the day, it’s about the material, its freshness and provenance,” said David Benrimon, whose family operates three galleries in New York.

“Sleeping Girl” surpassed the high estimate of $40 million and the previous Lichtenstein record of $43.2 million, set six months ago at Christie’s.

The 3-by-3-foot image of a sultry blonde was in the collection of Phil and Beatrice Gersh, who bought it from the Ferus Gallery in Los Angeles in 1964, the year it was painted. The Gershes were founding members of the city’s Museum of Contemporary Art. Beatrice Gersh died last year. Her husband, a former talent agent, died in 2004.

“Sleeping Girl” tied for the top lot with Francis Bacon’s 1976 canvas “Figure Writing Reflected in Mirror.” That painting depicts a seated man scribbling on a white sheet of paper with his back and profile toward the viewer. The man is reflected in the mirror.

Pablo Picasso has been dethroned.

The world auction market’s top earner in recent years must yield to Chinese artist Zhang Daqian (1899-1983), according to a report from French research company Artprice.

Zhang generated $506.7 million in auction revenue in 2011. Close behind was compatriot Qi Baishi (1864-1957) with $445.1 million. They lead a group of more than 450,000 artists tracked by Artprice. Picasso ranked fourth at $311.6 million.

“When you couple China’s abundance of money and its rich history of collecting in all the categories of art, it’s not a surprise,” said Larry Warsh, a New York-based collector.

The change reflects China’s growing strength in the global art market. Of the approximately $11 billion total world revenue for fine art last year, China’s share was 39 percent, up from 33 percent the year before, Artprice said. The U.S. was No. 2 with 25 percent.

Andy Warhol came in third among artists in the Artprice report, with $324.8 million. The fifth slot was occupied by yet another Chinese name, Xu Beihong (1895-1953), who tallied $212.9 million.

These Chinese “artists are maybe not well-known on the art scene but they are the leading modern masters in China,” said Martin Bremond, head economist at Artprice. “They are on top because China is the No. 1 country at auction and the Chinese are buying their own artists.”

Beating Still

Zhang is famous for his mastery of landscape painting and variety of styles, according to Melissa Chiu, director of the Asia Society Museum in New York. His 1947 “Lotus and Mandarin ducks” fetched HK$191 million ($24.5 million) at Sotheby’s in Hong Kong in May 2011, a record for the artist whose annual auction revenue increased by about 13 times in the past two years.

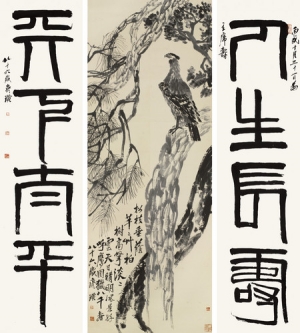

Qi is best known for his ink depictions of animals, birds and insects on paper and silk, Chiu said. His somber ink painting “Eagle Standing on Pine Tree; Four-Character Couplet in Seal Script” fetched 425.5 million yuan ($65.5 million) at China Guardian Auctions Co. in Beijing in May 2011.

A British couple may have unearthed a long-lost portrait of Vincent Van Gogh after buying it off the internet for just £1,500.

The pastel drawing is believed to be the only full-length portrait of the genius artist in existence and could be worth millions if authenticated.

It is thought to have been painted by a female artist who lived next door to him during his time in Paris.

The picture was simply described on an auction website as 'portrait of a man', but after extensive research, Michael and Mandy Cruickshank believe the work - painted in the 1880s - is of the legendary Dutch impressionist.

The painting was found in Versailles where it was last seen in public in 1892.

The couple, from Louth in Lincolnshire, became suspicious by the artist's crumpled hat, similar to one he sketched, and they believed it is the artist in the prime of his artistic career.

And their view is backed up by several art experts.

A detailed examination by facial recognition experts at the University of Dundee gave the work a four out of six on the chances of it being Van Gogh.

Caroline Erolin, a lecturer in medical and forensic art, said: 'We have scale for matching up likenesses running from no support to powerful support. We rated the painting as having support which is just below strong support which is second highest.

'We compared the painting with a well known self portrait, two other portraits and a photo of Van Gogh from the period. We were hampered slightly because it was a pastel drawing which is less clear, but there is a good case for it being Van Gogh.'

There a number of clues that painting may be of Van Gogh.

On the wall in the pastel, the words 'L'Incompris', meaning the misunderstood, are scrawled. Van Gogh was famous for writing on his own walls, according to experts.

The artist, Jeanne Donnadieu, wrote her address - 17 Rue Victor Massi - on the back of the original painting, seen in an exhibition in 1892.

The Cruickshanks discovered that the road's name had been changed in 1887.

Recent results at Skinner, Inc. in Boston offer further evidence that China is remaking the art market in every corner of the world. But can the Chinese art boom be sustained or is it a bubble that is bound to burst? Signs suggest that, short of radical realignment of the Chinese economy, the rally will continue though perhaps take different directions as supplies of classical Chinese art dwindle globally.

Consider this:

- The French auction market authority CVV reported in June that China had overtaken the United States as the biggest auction market in the world for art and antiques after sales in China more than doubled in a year to $10.8 billion.

- According to the World Wealth Report 2010, there are now 477,000 collectors in China.

- A study by the China Minsheng Bank claims that the Chinese spend at least $12.4 billion a year on art.

- According to the most recent Hunan report, mainland China has nearly a million millionaires.

Aggregated statistics about the art market are always hard to come by and these, like others, should be read with great caution. Nevertheless, there is no question that the sleeping dragon has awakened, as Skinner’s results underscore.

At $6.1 million, Skinner’s June 2-5 Asian art sale was the firm’s second largest grossing ever, in any category.

“When you consider that the top lot came in at $539,500 and only seven other lots exceeded the $100,000 mark, you can appreciate the incredible demand,” says Skinner department chief James Callahan, noting that the auction was 94 percent sold by lot.

Almost exclusively, Skinner’s buyers are mainland Chinese and their agents, a trend that has been increasing, says Callahan. Much of the buying at Skinner was in the room. Online bidding is steadily rising, too. Skinner has seen a five-fold increase in the dollar amount sold via the internet since the second quarter of 2009.

Skinner dominates its middle-market niche. “Sotheby’s and Christie’s have large sales of very good material, but also have high estimates and high pass rates. We have a more workable formula,” says Callahan. Paintings specialist Tianyue Jiang said prices at Skinner for old and modern Chinese painting of impeccable provenance rival results achieved in Hong Kong.

Eighteenth Century Qianlong carvings and porcelain and 19th and early 20th century paintings led sales at Skinner:

- Heavily carved with Immortals in a mountainous landscape, an 18th century bamboo brush pot, the sale’s cover lot, surpassed its $800/1,200 estimate to sell to a Chinese bidder for $539,500.

- A pair of Qianlong covered jars ornamented with landscape panels and foo dog lugs made $292,000 against an estimate of $600/800.

- A carved rhinoceros horn libation cup dating to the 18th century fetched $250,000 (est. $5/7,000).

- Carved with scholars amid rocky mountains, a 19th century wood sculpture on an ivory stand brought $106,650 (est. $5/700).

- Dating to the late 18th or early 19th century, a carved, white jade double-gourd vase and cover brought $142,200(est. $2/3,000).

aaaaa

- Ex-collection of Rhode Island Senator Theodore F. Green , a mounted leaf illustrated with a landscape in ink and colors on silk soared to $159,975 (est. $300/500).

The Chinese art boom is playing out in auction houses large and small around the world. Witness this:

- At Schultz Auctions in Clarence, N.Y., on May 7, a Qianlong moon vase fetched $1.55 million from a Shanghai dealer. It had been expected to bring $100,000.

- In London between May 9 and 13, a series of record-breaking Asian art sales tallied more than $88 million, more than triple the 2010 take.

- Sales of Asian art at Christie’s Hong Kong reached $489 million between May 27 and June 1. Fully 70 percent of the sales went to Chinese buyers from the mainland, Hong Kong and Taiwan. Ninety percent of the buyers of modern Chinese paintings were Chinese.

- On June 20, Michaan’s 403-lot sale of Fine Asian Works of Art grossed just under $2 million, an all time record for the Alameda, Ca., based auction house. A pair of horseshoe chairs fashioned from 16th and 17th century elements brought more than 17 times estimate, selling for $310,000.

- On June 21, sales reached $11.5 million at Bonhams & Butterfield’s auction of Fine Asian Works of Art in San Francisco. A pair of 18th century Chinese huanghuali yoke-back armchairs contributed $1.5 million to the total.

Writing in the June issue of Art + Auction, Souren Melikian noted a lack of discrimination among Chinese buyers as a whole and identified nationalism as the force driving what he calls the repatriation of Chinese works of art to the “homeland.”

But most experts believe that Chinese tastes are steadily becoming both more sophisticated and more adventurous.

“The Chinese are expanding. They are beginning to buy whatever they may feel is a good investment,” says New York dealer Joel Frankel, who has been trading in Chinese art for 44 years.

“There is a learning curve, but knowing the Chinese, it won’t take long,” agrees Callahan, who sees, for instance, an uptick in sales of beautifully crafted but undervalued Japanese art to Chinese buyers.

Meanwhile, do not expect pre-sale auction estimates to adjust to the market’s new reality anytime soon. As a recent Facebook exchange made clear, it is a brave, new Chinese world out there.

“Nice to know that I’m not the only who can’t put estimates on Chinese antiques,” said a Midwestern auctioneer.

“No reason to try,” replied his Mid Atlantic colleague.

Write to Laura Beach at This email address is being protected from spambots. You need JavaScript enabled to view it..

Recent results at Skinner, Inc. in Boston offer further evidence that China is remaking the art market in every corner of the world. But can the Chinese art boom be sustained or is it a bubble that is bound to burst? Signs suggest that, short of radical realignment of the Chinese economy, the rally will continue though perhaps take different directions as supplies of classical Chinese art dwindle globally. Consider this: - The French auction market authority CVV reported in June that China had overtaken the United States as the biggest auction market in the world for art and antiques after sales in China more than doubled in a year to $10.8 billion.

- According to the World Wealth Report 2010, there are now 477,000 collectors in China.

- A study by the China Minsheng Bank claims that the Chinese spend at least $12.4 billion a year on art.

- According to the most recent Hunan report, mainland China has nearly a million millionaires.

Aggregated statistics about the art market are always hard to come by and these, like others, should be read with great caution. Nevertheless, there is no question that the sleeping dragon has awakened, as Skinner’s results underscore. At $6.1 million, Skinner’s June 2-5 Asian art sale was the firm’s second largest grossing ever, in any category. “When you consider that the top lot came in at $539,500 and only seven other lots exceeded the $100,000 mark, you can appreciate the incredible demand,” says Skinner department chief James Callahan, noting that the auction was 94 percent sold by lot. Almost exclusively, Skinner’s buyers are mainland Chinese and their agents, a trend that has been increasing, says Callahan. Much of the buying at Skinner was in the room. Online bidding is steadily rising, too. Skinner has seen a five-fold increase in the dollar amount sold via the internet since the second quarter of 2009. Skinner dominates its middle-market niche. “Sotheby’s and Christie’s have large sales of very good material, but also have high estimates and high pass rates. We have a more workable formula,” says Callahan. Paintings specialist Tianyue Jiang said prices at Skinner for old and modern Chinese painting of impeccable provenance rival results achieved in Hong Kong. Eighteenth Century Qianlong carvings and porcelain and 19th and early 20th century paintings led sales at Skinner: - Heavily carved with Immortals in a mountainous landscape, an 18th century bamboo brush pot, the sale’s cover lot, surpassed its $800/1,200 estimate to sell to a Chinese bidder for $539,500.

- A pair of Qianlong covered jars ornamented with landscape panels and foo dog lugs made $292,000 against an estimate of $600/800.

- A carved rhinoceros horn libation cup dating to the 18th century fetched $250,000 (est. $5/7,000).

- Carved with scholars amid rocky mountains, a 19th century wood sculpture on an ivory stand brought $106,650 (est. $5/700).

- Dating to the late 18th or early 19th century, a carved, white jade double-gourd vase and cover brought $142,200(est. $2/3,000).

aaaaa

- Ex-collection of Rhode Island Senator Theodore F. Green , a mounted leaf illustrated with a landscape in ink and colors on silk soared to $159,975 (est. $300/500).

The Chinese art boom is playing out in auction houses large and small around the world. Witness this: - At Schultz Auctions in Clarence, N.Y., on May 7, a Qianlong moon vase fetched $1.55 million from a Shanghai dealer. It had been expected to bring $100,000.

- In London between May 9 and 13, a series of record-breaking Asian art sales tallied more than $88 million, more than triple the 2010 take.

- Sales of Asian art at Christie’s Hong Kong reached $489 million between May 27 and June 1. Fully 70 percent of the sales went to Chinese buyers from the mainland, Hong Kong and Taiwan. Ninety percent of the buyers of modern Chinese paintings were Chinese.

- On June 20, Michaan’s 403-lot sale of Fine Asian Works of Art grossed just under $2 million, an all time record for the Alameda, Ca., based auction house. A pair of horseshoe chairs fashioned from 16th and 17th century elements brought more than 17 times estimate, selling for $310,000.

- On June 21, sales reached $11.5 million at Bonhams & Butterfield’s auction of Fine Asian Works of Art in San Francisco. A pair of 18th century Chinese huanghuali yoke-back armchairs contributed $1.5 million to the total.

Writing in the June issue of Art + Auction, Souren Melikian noted a lack of discrimination among Chinese buyers as a whole and identified nationalism as the force driving what he calls the repatriation of Chinese works of art to the “homeland.” But most experts believe that Chinese tastes are steadily becoming both more sophisticated and more adventurous. “The Chinese are expanding. They are beginning to buy whatever they may feel is a good investment,” says New York dealer Joel Frankel, who has been trading in Chinese art for 44 years. “There is a learning curve, but knowing the Chinese, it won’t take long,” agrees Callahan, who sees, for instance, an uptick in sales of beautifully crafted but undervalued Japanese art to Chinese buyers. Meanwhile, do not expect pre-sale auction estimates to adjust to the market’s new reality anytime soon. As a recent Facebook exchange made clear, it is a brave, new Chinese world out there. “Nice to know that I’m not the only who can’t put estimates on Chinese antiques,” said a Midwestern auctioneer. “No reason to try,” replied his Mid Atlantic colleague. Write to Laura Beach at This email address is being protected from spambots. You need JavaScript enabled to view it..

|

|

|

|

|