|

Displaying items by tag: Art Market

There is an old joke that the clue to contemporary art is in the name: it is a con, and it is temporary. Even those inured to the industry’s excesses, however, might have been surprised by a report at the weekend about Damien Hirst. Not apparently content with his £215 million fortune, the original Young British Artist has allegedly taken to “bullying” auction houses into refusing to sell prints individually, insisting that they should be sold only as a complete package.

The work in question was In a Spin, the Action of the World on Things, a 4ft by 3ft box covered in one of Hirst’s iconic spin paintings, which are created by a machine pouring paint on to a canvas. Inside each box (Hirst made 68 of them) are 23 signed prints of spin images.

John Brandler, an art dealer in Essex, tried last month to sell two of the box-top paintings, valued around £75,000, via Phillips de Pury, the auctioneers. They refused, despite handling two similar sales recently, saying that Hirst was now opposed to anyone attempting to sell In a Spin without the accompanying prints. Given that many of these prints are already owned individually, bought for between £2,000 and £4,000, there are fears that people might have unwittingly bought an unrealisable investment.

Nonsense, said a spokeswoman for Hirst, blaming a “miscommunication internally” at the auctioneers. Hirst was interested only in ensuring that buyers knew the prints were part of one artwork and correctly attributed. He was not interested in preventing people selling what they wanted.

A more cynical soul might beg to differ. For Hirst, 46, has never shied away from squeezing every last drop of cash out of his work: on one occasion he forced a 16-year-old student who’d used an image of his diamond-studded skull for an internet collage to hand over £200.

Fears are growing about the potential impact of this summer’s renewed global economic turmoil on the art market. The 2008 financial crisis sharply hit art sales across all sectors, but the market bounced back quicker than many others, particularly for blue-chip works. At issue now are two diverging premises: that art is a luxury brand, as sensitive to stock markets as high-end fashion and first-class flights (this is the view of those looking at the art market from the outside); or that it represents a safe investment, sought after in troubled times much like gold and the Swiss franc (the view of those with more vested interests).

Dark clouds

Since art market professionals went on their summer break, the widening European sovereign debt crises and Standard & Poor’s downgraded opinion of the US debt triggered fears of a “double dip” recession, which saw stock markets fall worldwide.

The wealthy, especially in cities such as London and New York which rely heavily on their financial centres, all now have less to spend. The hedge fund SAC Capital, run by the art collector Steve Cohen, was down 4% for the first week of August alone.

In the luxury goods sector in Europe, share prices are down between 15% and 30%. “We see significant potential downside if the crisis mimics 2008,” said Julian Easthope, a research analyst at Barclays Capital in London. He looks closely at stocks, including France’s PPR, founded by Christie’s owner François Pinault.

Sotheby’s stock has certainly felt the pinch: since 7 July, it has lost 37% of its value (falling from $47.8 to under $30, as we went to press), wiping over $1.2 billion off the value of the company. This reduces the money available to it at a time when competition with Christie’s is already eating into its profits. In the fight for the best works, both auction houses need to offer increasingly attractive terms to consignors, which is reducing Sotheby’s profit margins (see p59).

The New York art world may be entering uncharted territory.

Why do we think so? Let’s look at the big picture: In June, dealers at the Art Basel fair reported that business was booming. Art, we were told in report after report, was selling as it had in the heady days of 2006 and 2007, when the housing crash and the worldwide economic crisis were merely theories in the heads of a few sharp-eyed economists and canny hedge fund managers.

Last month, the world’s two leading auction houses, Sotheby’s and Christie’s, announced record revenues for the first half of the year, having moved $3.4 billion and $3.2 billion worth of art and other goods, respectively.

Now, for New York: there are, at this moment, more galleries, more artists, more curators and—perhaps most significant—more square footage devoted to art than at any time in the city’s history. The art world has never been wealthier, and that wealth has never been more intensely concentrated.

A handful of top-flight galleries are vying for the attention of a growing number of unprecedentedly wealthy collectors. At the auction houses, guarantees (an amount promised to a seller regardless of what an artwork sells for), which vanished during the recession, are back on the table, an indication that the houses are again flush and ready to compete for consignments. Ambitious young dealers are entering the fray.

It is a thrilling moment, and a frightening one. Call it Boom 2.0.

As the stock market gyrated sharply in recent weeks, New York art dealer Asher Edelman began receiving calls from clients asking to sell works they owned by major 20th-century artists, including Pablo Picasso, Roy Lichtenstein and Robert Rauschenberg.

And the sellers -- collectors, investors and other dealers -- were willing to take about 20 percent less than they would have only a couple of weeks earlier, Edelman said.

“I think there’s a big fear factor out there,” said Edelman, a former Wall Street investor and the founder of art- financing company Art Assure Ltd. “People are afraid of what’s going on in the world and they want to take some cash out of their art.”

This month’s wild swings of the stock markets included the Dow Jones Industrial Average alternating between gains and losses of more than 400 points for four days in a row during the week ending Aug. 12, the longest such streak ever.

“Whenever you have stock price declines, you do get a lot of margin calls, and people look for any form of liquidity that they can find,” said Brian Jacobsen, chief portfolio strategist at Wells Fargo Advantage Funds in Menomonee Falls, Wisconsin.

Some art owners try to sell privately and avoid the risk of having the work flop at auction. Others are looking for a financial guarantee by a third-party before putting art on the auction block. Many are using their collections to obtain credit lines.

Thirst for Liquidity

“In the last three months, we’ve seen an increase in new clients who want to use art as collateral for loans,” said Suzanne Gyorgy, director of art advisory and finance services at Citibank’s private-banking unit. “They anticipate market volatility and want to have liquidity available for investment opportunities.”

Art Finance Partners, a private New York firm that also lends money using art as collateral, saw a sharp rise in inquiries this month, according to partner Meghan Carleton.

“People need to figure out where their sources of capital may be coming from in the next 30 to 60 days,” she said. “It’s about short-term liquidity.”

The art market’s top tier would likely benefit because it’s increasingly seen by collectors as an alternative to the volatile capital markets, dealers and analysts said.

“We expect a very strong auction season this fall as high- net-worth individuals globally reallocate more funds into top- quality art for value-preservation purposes,” said Sergey Skaterschikov, founder of Skate’s Art Market Research, in an e- mail.

Sotheby’s (BID) shares plunged as much as 20 percent today amid concern that the art market rally since the 2008 financial crisis will fizzle.

Shares of the publicly traded auctioneer closed down $5.17, or 13 percent, to $33.44, and are off 39 percent since their April 5 high this year. In the past three sessions, they’re down 16 percent.

Stocks around the world have tumbled as investors fretted about a global relapse into recession. Late Friday, Standard & Poor’s cut the U.S. credit rating.

“Global financial equity markets are a proxy for global wealth,” said Rommel Dionisio, an analyst with Wedbush Securities, who has an “outperform” rating on the shares. “There’s reason for concern. It depends on how pronounced or severe this downturn is.”

On Aug. 3, Sotheby’s reported its best-ever quarterly profit of $127 million, with record sales of $3.4 billion for the first half of 2011. In a conference call after the earnings release, Chief Executive Officer William Ruprecht said he believed “market volatility” around the world “in other arenas” has encouraged participation in the art market.

Ruprecht also referred to economic volatility “that the media is awfully good at frightening people with on a daily basis.”

The Contemporary

Last month I left off at the HUGE London sales with the catalogs weighing in at 17.37 lbs. This series started on the evening of June 28th at Christie's and as expected, there was plenty of action. Taking to top three positions were Francis Bacon's Study for a Portrait (est. upon request - and I never requested it) that made £17.9M ($28.7M), Warhol's Mao, 1973 (est. £6-8M) at £6.98M and Peter Doig's Red Boat (est. £1.4-£1.8M) at £6.2M - the Doig was bought in 2004 for $162,000 and there was a little legal issue that arose prior to the sale ... to read more, click here: Legal Issue , and then the parties reached an agreement so the work could be sold: Agreement .

When the evening session ended, of the 65 works offered, 53 sold leaving a sell-through rate of 82% and a total take of £78.8M ($125.8M); the expected range was £55.3M - £76.7M, so with the buyer's premium they beat their expectations with only 82% selling - showing that the highly contested works will bring in the bacon!!!

On the 29th they followed with their day sale and taking the top positions here were Richter's Untitled, 1969 which sold for £481K ($770K - est. £350-£450K), Dubuffet's Frequented Neighbourhood, 1979 at £409K ($654K - est. £100-£150K) and Warhol's Portrait of Florinda Bolkan at £361K ($578K - est. £90-£120K). Of the 249 works offered 186 sold (75.1% sell-through rate) and a total take of £13.2M ($21M)

At the end of Christie's two days their totals were: 314 offered, 239 sold (76.1% sell-through rate) and a total take of £92M ($147M) ... and then came Sotheby's.

That same evening the competition launched their attack and taking top position here was ... go on, take a guess ... Francis Bacon's Crouching Nude, that sold for £8.3M ($13.3M - est. £7-£9M). In second was Polke's Jungle that made an auction record £5.7M ($9.2M - est. £3-£4M) and in third was Basquiat's Untitled at £5.4M ($8.7M - est. £5-£7M). At the close of the evening, of the 88 works offered, 79 sold (89.8% sell-through rate) and the total take was £108.8M ($174.1M) ... not only better than the competitions evening sale, but besting their combined evening and days sales.

On the 30th they followed with their day sale and the top item here was John Currin's Edwardian at £713K ($1.14M - est. £300-£400K) and coming in second was Parrino's Purple Monster Shifter and Zao Wou-Ki's 20.8.84 each at £601K ($967K - est. £150-£250K). When the day was done, of the 250 works offered 202 sold for a sell-through rate of 80.8% and a total take of £19.8M ($31.9M) ... again, beating the competition and topping their presale estimate of £13.3 - £18.8M.

At the end of their two days, Sotheby's racked up 128.6M ($206M) from the sale of 281 work (338 were offered) and leaving a nice sell-through rate of 83.1%.

For the week, the combined totals were: 652 works offered, 520 sold (79.75%) and a total take of £220.6M ($352.8M) - not too bad!

Old Masters

We then rolled into July with the Old Masters and while there were some fireworks, my overall impression is, and always has been, that July is a tough time to sell art. Let's face it; this is the time of the year when many people are more concerned about some fun in the sun.

On the evening of the 5th Christie's offered their Old Master & British Paintings (finally -- no 19th century works) and the top lot here was George Stubbs' Gimcrack on Newmarket Heath at £22.44M ($35.9M - est. £20-£30M) ... now while this was an auction record for the artist it should be noted that the work had a 'third party guarantee' (in other words, before the sale they basically presold the work). So, should that really be considered an auction sale since the work sold at what appears to have been the reserve? Not in my opinion. For more on this read Souren Melikian's take - Eagerness to Buy Old Masters at Odds With Their Availability in Auctions. Anyway, let's move on ... the number two position was taken by Gainsborough's Portrait of Mrs. William Villebois at £6.5M ($10.5M - est. £4-£6M) and in third was Michelangelo's drawing A Male Nude Seen from Behind that fetched £3.2M ($5.1M - est. £3-£5M).

When the evening ended, of the 61 works offered 41 sold (a sell-through rate of 68%) giving a total take of £49.7M ($79.6M). Last year's corresponding sale offered 56, sold 28 (67.8% sell-through) and took in £39M ($59.2M) - top lot here was a Rubens at £9M ($13.6M) ... so it was the extra £10M for the Stubbs that made the difference between 2010 and 2011. It was also interesting to note that the top 10 lots in the 2011 sale made £40M (about 80% of the gross).

On the 6th they followed with the Day Sale which further strengthened my conclusions that July is not the time to sell ... of the 118 works offered only 55 sold, leaving a sell-through rate of 47% and a total take of £2.3M ($3.8M). Top lot here was The Master of the Legend of Saint Mary Magdalene's A Triptych which made £301K ($483K - est. £120-180K). In case you are wondering, which I am sure you are not, but I am going to tell you anyway, the top 10 works in this sale made £1.1M or 46.4% of the total take.

Between these two sales there were 179 works offered with 96 finding buyers (53.6% - not very impressive) and a total take of £52.1M ($83.4M).

The evening of the 6th brought on Sotheby's offerings and the results were on par with the competition. Top lot here was a large Francesco Guardi scene of Venice that brought £26.7M ($42.9M - est. £15-£20M), in second was a Correggio Madonna and Child at 3.6M ($5.8M - est. 2-3M) and in third was Schaufelein's The Dormition of the Virgin and Christ... at £2.7M ($4.4M - est. £1.5-£2M). When this session ended, of the 73 works offered 50 sold (68.5% sell-through rate) and a total take of £47.6M ($76.5M) - a wash with Christie's. In the corresponding 2010 sale, Sotheby's offered 57, sold 39 (68.4% sell-through) and a total take of £53.5M ($80.8M) - they had a Turner in the sale that made £29.7M (44.9M). Still comes down to one or two paintings making all the difference.

Over the next two days Sotheby's offered 3 more general sales featuring Old Master and British Paintings ... to save time, here are the main highlights. The true 'Day Sale' found 268 offerings with 179 finding buyers (66.8% sell-through rate ... much better than Christie's) and a total take of £9.5M ($15.2M) - top lot was a work by the Studio of Vanvitelli that made £719K ($1.15M - est. £15-20K ... at least two people believe it could be and actual Vanvitelli).

This was followed by a Drawings sale which had 333 lots and sold just 167 (50.2% sell-through rate) for a total take of £3.5M ($5.6M). Top lot here was Ligozzi's A Sultan Standing Beside a Goat at £469K ($749K - est. £150-£200K. And then on the 8th they offered an Old Master Sculpture & Works of Art sale which had 112 works, sold 60 (53.6%) and took in £2.65M ($4.2M). Top lot here was a German Walnut Half-Relief at £529K ($845K - est. £60-£80K).

When the Sotheby's sessions were finished we saw 786 works offered with 456 finding buyers (58%) for a total of £63.3M ($101.5M). The gross was better than the competition, but it took them more than 4 times the number of works to accomplish this - not very impressive.

By the end of the week the two rooms had offered 965 works, sold 552 (57.2%) and grossed £115.4M ($185M). It appears that the salerooms are now throwing out whatever they can in the hopes that some of it sticks and they make their numbers ... this is fine for them, but not very good for all the people whose works did not sell.

On the bright side, at least Christie's is offering smaller and tighter sales and this showed in their Price Per Lot Sold: $868,692 versus Sotheby's rather dismal $222,658 ... come on boys and girls: get with the program!

Lifestyles of the Rich and Famous

As if they had not put enough works on the market that week, the two main London rooms created sales geared exclusively towards the rich and famous. Now I know you are asking: More? You are kidding? Nope! After a while you just have to laugh at this. However, what the results will continue to show is that for the right material, there are tons, and I mean tons, of money available.

During the Old Master week Sotheby's offered Treasures, Princely Taste which featured 33 very expensive items, including furniture, vases, clocks, etc. Of these, 20 sold (60.6%) for a total take of £10.8M ($17.4M) - top lot was a pair of Italian carved giltwood settees at £1.7M ($2.8M - est. £300-£500K). The next day Christie's offered The Exceptional Sale, 2011 ... who comes up with these titles? I heard that some of the other options were: Most Of You Cannot Afford This Stuff Sale, Show Us The Money Sale, Stuff For the Super Rich, The Big Bucks Sale, Black Card Holders Only Sale ... just kidding, I think! Of the 50 items offered 36 sold (72%) creating a total take of £28.8M ($45.9M) - not too shabby. Top lot here was a set of four Chinese vases which were purchased by Wynn Macau, Ltd. (Steve Wynn) for £8M ($12.7 - est. £600-1M) - guess you need something to attract people to a CASINO!

I would have delved deeper into these sales, but if you click on the following link: Buyers Scoop Up the Trophies at Auction, Mr. Melikian has done a nice job so there was no reason to rehash it.

What all of these sales continue to illustrate is the desire by people with some 'extra money' to find alternative areas to 'invest'; and this is not limited to the extremely wealthy. There is continued demand for the best in all areas and price levels of the art and antiques market. Our gallery has been lucky to have enjoyed continued interest in the works we are offering ... the partial list of works passing through the gallery during the normally quiet month of July testifies to this.

The Contemporary Last month I left off at the HUGE London sales with the catalogs weighing in at 17.37 lbs. This series started on the evening of June 28th at Christie's and as expected, there was plenty of action. Taking to top three positions were Francis Bacon's Study for a Portrait (est. upon request - and I never requested it) that made £17.9M ($28.7M), Warhol's Mao, 1973 (est. £6-8M) at £6.98M and Peter Doig's Red Boat (est. £1.4-£1.8M) at £6.2M - the Doig was bought in 2004 for $162,000 and there was a little legal issue that arose prior to the sale ... to read more, click here: Legal Issue , and then the parties reached an agreement so the work could be sold: Agreement . When the evening session ended, of the 65 works offered, 53 sold leaving a sell-through rate of 82% and a total take of £78.8M ($125.8M); the expected range was £55.3M - £76.7M, so with the buyer's premium they beat their expectations with only 82% selling - showing that the highly contested works will bring in the bacon!!! On the 29th they followed with their day sale and taking the top positions here were Richter's Untitled, 1969 which sold for £481K ($770K - est. £350-£450K), Dubuffet's Frequented Neighbourhood, 1979 at £409K ($654K - est. £100-£150K) and Warhol's Portrait of Florinda Bolkan at £361K ($578K - est. £90-£120K). Of the 249 works offered 186 sold (75.1% sell-through rate) and a total take of £13.2M ($21M) At the end of Christie's two days their totals were: 314 offered, 239 sold (76.1% sell-through rate) and a total take of £92M ($147M) ... and then came Sotheby's. That same evening the competition launched their attack and taking top position here was ... go on, take a guess ... Francis Bacon's Crouching Nude, that sold for £8.3M ($13.3M - est. £7-£9M). In second was Polke's Jungle that made an auction record £5.7M ($9.2M - est. £3-£4M) and in third was Basquiat's Untitled at £5.4M ($8.7M - est. £5-£7M). At the close of the evening, of the 88 works offered, 79 sold (89.8% sell-through rate) and the total take was £108.8M ($174.1M) ... not only better than the competitions evening sale, but besting their combined evening and days sales. On the 30th they followed with their day sale and the top item here was John Currin's Edwardian at £713K ($1.14M - est. £300-£400K) and coming in second was Parrino's Purple Monster Shifter and Zao Wou-Ki's 20.8.84 each at £601K ($967K - est. £150-£250K). When the day was done, of the 250 works offered 202 sold for a sell-through rate of 80.8% and a total take of £19.8M ($31.9M) ... again, beating the competition and topping their presale estimate of £13.3 - £18.8M. At the end of their two days, Sotheby's racked up 128.6M ($206M) from the sale of 281 work (338 were offered) and leaving a nice sell-through rate of 83.1%. For the week, the combined totals were: 652 works offered, 520 sold (79.75%) and a total take of £220.6M ($352.8M) - not too bad! Old Masters We then rolled into July with the Old Masters and while there were some fireworks, my overall impression is, and always has been, that July is a tough time to sell art. Let's face it; this is the time of the year when many people are more concerned about some fun in the sun. On the evening of the 5th Christie's offered their Old Master & British Paintings (finally -- no 19th century works) and the top lot here was George Stubbs' Gimcrack on Newmarket Heath at £22.44M ($35.9M - est. £20-£30M) ... now while this was an auction record for the artist it should be noted that the work had a 'third party guarantee' (in other words, before the sale they basically presold the work). So, should that really be considered an auction sale since the work sold at what appears to have been the reserve? Not in my opinion. For more on this read Souren Melikian's take - Eagerness to Buy Old Masters at Odds With Their Availability in Auctions. Anyway, let's move on ... the number two position was taken by Gainsborough's Portrait of Mrs. William Villebois at £6.5M ($10.5M - est. £4-£6M) and in third was Michelangelo's drawing A Male Nude Seen from Behind that fetched £3.2M ($5.1M - est. £3-£5M). When the evening ended, of the 61 works offered 41 sold (a sell-through rate of 68%) giving a total take of £49.7M ($79.6M). Last year's corresponding sale offered 56, sold 28 (67.8% sell-through) and took in £39M ($59.2M) - top lot here was a Rubens at £9M ($13.6M) ... so it was the extra £10M for the Stubbs that made the difference between 2010 and 2011. It was also interesting to note that the top 10 lots in the 2011 sale made £40M (about 80% of the gross). On the 6th they followed with the Day Sale which further strengthened my conclusions that July is not the time to sell ... of the 118 works offered only 55 sold, leaving a sell-through rate of 47% and a total take of £2.3M ($3.8M). Top lot here was The Master of the Legend of Saint Mary Magdalene's A Triptych which made £301K ($483K - est. £120-180K). In case you are wondering, which I am sure you are not, but I am going to tell you anyway, the top 10 works in this sale made £1.1M or 46.4% of the total take. Between these two sales there were 179 works offered with 96 finding buyers (53.6% - not very impressive) and a total take of £52.1M ($83.4M). The evening of the 6th brought on Sotheby's offerings and the results were on par with the competition. Top lot here was a large Francesco Guardi scene of Venice that brought £26.7M ($42.9M - est. £15-£20M), in second was a Correggio Madonna and Child at 3.6M ($5.8M - est. 2-3M) and in third was Schaufelein's The Dormition of the Virgin and Christ... at £2.7M ($4.4M - est. £1.5-£2M). When this session ended, of the 73 works offered 50 sold (68.5% sell-through rate) and a total take of £47.6M ($76.5M) - a wash with Christie's. In the corresponding 2010 sale, Sotheby's offered 57, sold 39 (68.4% sell-through) and a total take of £53.5M ($80.8M) - they had a Turner in the sale that made £29.7M (44.9M). Still comes down to one or two paintings making all the difference. Over the next two days Sotheby's offered 3 more general sales featuring Old Master and British Paintings ... to save time, here are the main highlights. The true 'Day Sale' found 268 offerings with 179 finding buyers (66.8% sell-through rate ... much better than Christie's) and a total take of £9.5M ($15.2M) - top lot was a work by the Studio of Vanvitelli that made £719K ($1.15M - est. £15-20K ... at least two people believe it could be and actual Vanvitelli). This was followed by a Drawings sale which had 333 lots and sold just 167 (50.2% sell-through rate) for a total take of £3.5M ($5.6M). Top lot here was Ligozzi's A Sultan Standing Beside a Goat at £469K ($749K - est. £150-£200K. And then on the 8th they offered an Old Master Sculpture & Works of Art sale which had 112 works, sold 60 (53.6%) and took in £2.65M ($4.2M). Top lot here was a German Walnut Half-Relief at £529K ($845K - est. £60-£80K). When the Sotheby's sessions were finished we saw 786 works offered with 456 finding buyers (58%) for a total of £63.3M ($101.5M). The gross was better than the competition, but it took them more than 4 times the number of works to accomplish this - not very impressive. By the end of the week the two rooms had offered 965 works, sold 552 (57.2%) and grossed £115.4M ($185M). It appears that the salerooms are now throwing out whatever they can in the hopes that some of it sticks and they make their numbers ... this is fine for them, but not very good for all the people whose works did not sell. On the bright side, at least Christie's is offering smaller and tighter sales and this showed in their Price Per Lot Sold: $868,692 versus Sotheby's rather dismal $222,658 ... come on boys and girls: get with the program!

Lifestyles of the Rich and Famous As if they had not put enough works on the market that week, the two main London rooms created sales geared exclusively towards the rich and famous. Now I know you are asking: More? You are kidding? Nope! After a while you just have to laugh at this. However, what the results will continue to show is that for the right material, there are tons, and I mean tons, of money available. During the Old Master week Sotheby's offered Treasures, Princely Taste which featured 33 very expensive items, including furniture, vases, clocks, etc. Of these, 20 sold (60.6%) for a total take of £10.8M ($17.4M) - top lot was a pair of Italian carved giltwood settees at £1.7M ($2.8M - est. £300-£500K). The next day Christie's offered The Exceptional Sale, 2011 ... who comes up with these titles? I heard that some of the other options were: Most Of You Cannot Afford This Stuff Sale, Show Us The Money Sale, Stuff For the Super Rich, The Big Bucks Sale, Black Card Holders Only Sale ... just kidding, I think! Of the 50 items offered 36 sold (72%) creating a total take of £28.8M ($45.9M) - not too shabby. Top lot here was a set of four Chinese vases which were purchased by Wynn Macau, Ltd. (Steve Wynn) for £8M ($12.7 - est. £600-1M) - guess you need something to attract people to a CASINO! I would have delved deeper into these sales, but if you click on the following link: Buyers Scoop Up the Trophies at Auction, Mr. Melikian has done a nice job so there was no reason to rehash it. What all of these sales continue to illustrate is the desire by people with some 'extra money' to find alternative areas to 'invest'; and this is not limited to the extremely wealthy. There is continued demand for the best in all areas and price levels of the art and antiques market. Our gallery has been lucky to have enjoyed continued interest in the works we are offering ... the partial list of works passing through the gallery during the normally quiet month of July testifies to this.

The market for contemporary art is more resilient than it was three years ago, according to Dallas- based collector Howard Rachofsky.

The former hedge fund manager, who with his wife Cindy is one of the art world’s best-known buyers, spoke after auctions showed some contemporary prices returning to their peak levels, defying nervousness in the wider economy.

“There’s so much wealth in the world looking for alternative assets,” said Rachofsky. “The market is broader than it was. It’s grown with new buyers from Asia, Eastern Europe and the Middle East. A number of players have come in from the financial industry and they look for value.”

Wealthy individuals are investing in contemporary works as a hedge against economic uncertainty, dealers said. Sotheby’s and Christie’s International’s June series of contemporary art auctions in London raised 220.6 million pounds ($352 million), the second-highest total ever for the U.K. capital.

Still, the market isn’t fully back to the boom levels of 2007 and mid-2008, Rachofsky, 67, said in a telephone interview.

“Some prices are high and comparable to former values,” he said. “It’s not universal. There isn’t a mania out there. If the financial markets go into crisis, there will be deflation in art as well. There will be a pause.”

Dealers at last month’s Art Basel fair in Switzerland reported plentiful sales in the $200,000 to $2 million range. Buyers spent a record 108.8 million pounds at Sotheby’s on June 29, when the little-known Duerckheim collection of 1960s and ‘70s German art fetched 60.4 million pounds, double the estimate. Works by Sigmar Polke and Georg Baselitz set auction records for the artists at 5.8 million pounds and 3.2 million pounds apiece.

Koons Market

“Those prices showed that the Polke and Baselitz markets had been quiet and underpriced,” Rachofsky said. “The Jeff Koons market is still off right now, though. Prices aren’t at the level of 2008.”

A 1980s sculpture of 18 basketballs in a vitrine by Koons failed to find a buyer at Sotheby’s (BID) against a low estimate of 600,000 pounds. In June 2008, during the final months of the boom, Rachofsky sold the artist’s 1995-2000 sculpture “Balloon Flower (Magenta)” at Christie’s for a record 12.9 million pounds to finance other purchases. Auction prices for heavily traded names such as Koons slumped by as much as 50 percent during the crisis.

Sotheby’s auction sales for the first six months of the year reached $2.91 billion (£1.8 billion), a 35 per cent increase on last year, nearing its first six months record $2.95 billion in 2008. Christie’s auction sales figures are not yet available, but are thought to be close.

The figures were topped up by one of the most successful fortnights of Impressionist, modern and contemporary art auctions in London, which ended last Thursday, and realised £516.2 million, the third highest on record for such a series in London, just a fraction behind the £520 million achieved in February 2008. The Impressionist and modern art sales, which I reviewed last week, were dominated by the more modern art and realised close to £280 million, second only, in London, to the June 2008 series of £298 million.

Last week it was the turn of post-war and contemporary art, the area that was most hit by the recession. Having lagged far behind the Impressionist and modern art market during 2010, contemporary art is catching up again, and the sales last week brought just over £236 million, a 102 per cent increase on last summer. In spectacular fashion, Sotheby’s achieved the highest total for a single contemporary art auction outside New York of £109 million.

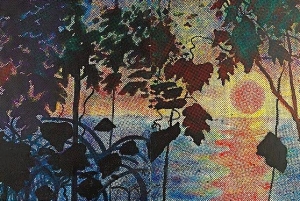

A couple of observations can be made. Painting, and predominantly figurative painting, though not necessarily in the conventional sense, was in the ascendant. Big prices were paid at Christie’s for a darkly ominous portrait by Francis Bacon (£18 million to a Russian buyer), a West Indian river scene by Peter Doig (£6.2 million to a US buyer), and a vertiginous view of a bull ring by the Spanish artist, Miquel Barcelo (£4 million to a European buyer). And at Sotheby’s records tumbled for the German new wave paintings of the 1960’s - satirical, expressive and fundamentally figurative - by Sigmar Polke (£5.7 million from a European buyer for ‘Jungle’, pictured), and Georg Baselitz (£3.2 million from the American trade for ‘Spekulatius’, pictured). European, and especially the German art from the collection of Count Duerkheim, eclipsed the American art on offer. Much of this, though classified as ‘contemporary’, was in fact historic, dating from the 50’s and 60’s, by artists now of the older generation, or no longer living.

Last November, Andy Warhol's 1962 painting "Men in Her Life" sold for over $60 million at Phillips de Pury & Co. It went for well over its high estimate, and became the second most expensive Warhol painting ever to sell at public auction. Because both the buyer and the under bidder were on the phone, the scenario was ripe for speculation. Some market observers and journalists wondered if there had been foul play, and talk arose, as it does from time to time, that the fast-paced, loosey-goosey art market was in need of regulation.

With the major biannual contemporary art sales at Christie's, Sotheby's and Phillips once again upon us, it's worth remembering the fuss over Warhol's 82-inch painting which, through a single, repeated photographic image, tells the story of a famous love triangle. Liz Taylor is at a racetrack squeezed between her movie producer husband Mike Todd and his best friend, crooner Eddie Fisher, who was then married to starlet Debbie Reynolds. Todd's marriage to the beautiful Taylor, then a dewy 24, was his third; when he died in a plane crash in 1958 it would take less than a year for Fisher to dump his own spouse, hook up with his dead friend's young widow and marry her in 1959. As it turned out, this spelled doom for Fisher, because his clean-cut showbiz persona was, in part, dependent on a storybook-perfect marriage to the wholesome Reynolds. It wasn't long before the unfavorable publicity surrounding his affair and divorce prompted cancellation of his television series with NBC and his recording contract with RCA. By 1964, his marriage to Taylor had also ended. Warhol's painting captures the beginning of what would be a series of disasters for both men.

The same week that Philips sold "Men in Her Life," Sothebys's sold a large 1962 Warhol painting, "Coca-Cola [4] Large Coca-Cola," for $35 million. They are both from the artist's early, and most valuable, period, but for me the similarity between them ends there: the Coca Cola bottle is merely a great hand-painted early pop image, whereas the newspaper-appropriated image of Liz's love triangle is representative of Warhol's most important contribution to art history, and well worth double what the other painting sold for.

All it takes is two bidders to chase a painting well past its presale estimate, and nowhere in any catalog does it say, "Please don't overpay." Do we really need a regulation setting these prices in their appropriate ratios to insure that clients don't overpay? Auctions today are about theater. Face it: it's pretty amazing to see such large quantities of money lavished on works of art whose value is strictly subjective. No matter how great they are, they aren't gold mines or oil wells.

As much as I love Warhol, the blockbuster prices at the high end feel like they're topping out. This season yet another large Warhol "Fright Wig" self-portrait comes up at auction, and once again it has been dubbed "the last in private hands." This blazing red one from collectors Norah and Norman Stone of San Francisco carries a $40 million price (a purple one made $32.5 million last year). Also on offer is a blue Liz, estimated at over $20 million, and an assemblage of "16 Jackies" priced at $25 million. There is little oxygen in the upper reaches of this market, but eventually a picture will crash and the cycle will turn or slow down. Until that happens, the auction experts will continue to source the material and find the clients, season after season. But then again, maybe it won't happen. Maybe, like Columbus, we'll find that the world of demand for Warhol is bigger than we thought it was. Meanwhile, the sums traded for these top lots are staggering, and the brouhaha surrounding them adds to the conviction of some that regulation lurks just around the corner.

The last time the government interfered in the art market was after the scandal over the price-fixing arrangement between Sotheby's and Christie's. It's been over 10 years since this debacle, and still the pain is fresh. Remember when Christopher Davidge, then CEO of Christie's, ratted out his competitor, Sotheby's, took $7 million in severance and jetted off with the young, attractive Asian art specialist Amrhita Jhaveri? Both Christie's chairman Sir Anthony Tennant and Sotheby's chairman Alfred Taubman were found guilty of price fixing under U.S. antitrust laws, but only Mr. Taubman was incarcerated — he spent 10 months in prison — because there is no applicable criminal law in the U.K.

|

|

|

|

|