|

Displaying items by tag: sales

Christie’s announced that its Buyer’s Premium will be an amount equal to 25% of the hammer price of each lot up to and including $100,000; 20% of the hammer price from $100,001 up to and including $2,000,000; and 12% of any sales above $2,000,001. Christie’s previously charged 25% of the hammer price up to and including $75,000; 20% on the amount from $75,001 to $1.5 million; and 12% on anything exceeding $1.5 million.

This is the second time that Christie’s has adjusted its Buyer’s Premium, a fee charged to buyers at auction, this year. Prior to the initial change, which went into effect on March 11, 2013, Christie’s Buyer’s Premium had been unchanged since 2008.

Christie’s first-half sales increased by 9% thanks in part to its record postwar and contemporary art sale, the most expensive auction ever held. The sale, which took place May 15th in New York, garnered $495 million and set 23 new salesroom highs for artists including Jackson Pollock and Jean-Michel Basquiat. Christie’s brought in over $1 billion in total contemporary art sales.

Interest in postwar and contemporary art has increased significantly in the past few years. This year alone Christie’s saw a 52% rise in new clients bidding on contemporary works less than $200,000. The auction house’s second most lucrative category was impressionist and modern art, which fetched over $625 million during the first-half.

Christie’s releases its sales total twice a year. The auction house’s total first-half sales reached $3.6 billion.

Online retail giant Amazon is expected to launch a virtual art gallery later this year. The website is planning on offering over 1,000 objects from at least 125 galleries. It has been rumored that the online seller of books, electronics and apparel already has over 100 galleries on board. The Seattle-based company has been approaching a litany of galleries across the U.S. in recent months.

The virtual art gallery will follow a similar model as Amazon Wine, which debuted last fall and works with over 400 vineyards and winemakers across the country. Amazon will take a commission from all sales on its art site instead of charging galleries a monthly service fee. Commissions will range from 5% to 15% based on the work’s sale price.

Online art galleries are not unheard of in today’s web-dominated world. Costco currently runs a virtual art gallery that offers prints by artists such as Henri Matisse (1869-1954) and Marc Chagall (1887-1985) as well as original works by lesser-known artists.

The 44th edition of Art Basel closed on Sunday, June 16, 2013 after welcoming a record 70,000 visitors. Exhibitors at the highly anticipated fair reported exceptionally strong sales throughout the show’s six-day run and patrons were impressed by the quality of the works offered.

This year, Art Basel hosted 304 international exhibitors at Messe Basel, a venue situated at the border of Switzerland, France and Germany. Among the offerings were paintings, drawings, sculptures, and photographs, which drew strong sales across the board. The buying frenzy began during the fair’s two-day VIP opening, which lasted from June 11th through the 12th and saw the $12 million sale of Alexander Calder’s (1898-1976) Sumac (1961) by London’s Helly Nahmad Gallery.

Next year, Art Basel will be held from June 19-22, 2014.

German police arrested two people and raided 28 locations in an effort to halt a multi-million dollar international forgery ring responsible for selling fake paintings they claimed were by Russian avant-garde artists including Wassily Kandinsky (1866-1944). Apartments, business premises, and art galleries in Wiesbaden, Mainz, Suttgart, Munich, and Hamburg were searched by police officers. Over 1,000 items were seized including supposed forgeries and sales documents. Additional searches were carried out in Switzerland and Israel.

The forgers are believed to have sold over 400 works ranging in price from $1,332 to over $1 million since 2005, accruing more than $2.7 million. The two men who were arrested are believed to be the leaders of an international group of six counterfeiters. Private collectors in Germany and Spain acquired most of the fakes sold by the forgery ring.

Confidence in the German art market has been unstable since it was shaken by the largest forgery scandal to date in 2011. Art forger Wolfang Betrachhi was sentences to six years in jail after admitting to painting copies of works by Fernard Leger (1881-1955) and Max Ernst (1891-1976) and then selling them as masterpieces to unwitting collectors.

The American art sale, which took place today, May 23, 2013 at Christie’s in New York, realized $50.8 million, the highest total that the category has seen since May 2008. 99 out of the 135 lots offered sold and 85% sold by value.

The auction’s top lot was Edward Hopper’s (1882-1967) oil on canvas painting Blackwell’s Island (1928), which brought $19.1 million (estimate: $15 million-$20 million). Hopper also took the sale’s second top spot with his watercolor on paper Kelly Jenness House (1932), which sold for $4.1 million (estimate: $2 million-$3 million) and set the auction record for a work on paper by the artist. The Hopper sales reinforced the artist’s continued popularity among buyers and the strong market demand for exceptional Modernist works.

A highly anticipated collection of six paintings by the Wyeth family of artists sold for upward of $2 million. The works by N.C. (1882-1945), Andrew (1917-2009), and Jamie Wyeth (b. 1946) were put up for sale by New Jersey-based businessman and avid collector of the Wyeths’ works, Eric Sambol. The highlight of the collection was N.C. Wyeth’s Norry Seavey Hauling Lobster Traps Off Blubber Island (1938), which garnered nearly $844,000.

Other significant sales from the auction included Norman Rockwell’s (1894-1978) Starstruck (1934), which brought over $2 million, exceeding its high estimate of $1.2 million, Georgia O’Keeffe’s (1887-1986) My Back Yard (1943), which was purchased by the Cincinnati Art Museum for $1.8 million (estimate: $1 million-$1.5 million), George Bellows’ (1882-1925) Splinter Beach (1913), which achieved $1.2 million (estimate: $500,000-$700,000), and Sanford Robinson Gifford’s (1823-1880) Tappan Zee (1879-80), which sold for $1.1 million (estimate: $200,000-$300,000).

After a whirlwind of auctions last week in New York, which included a historic $495 million post-war sale at Christie’s, Phillips’ Contemporary Art Evening Sale on May 16, 2013 seemed quite subdued. The boutique auction house’s sale garnered $78.6 million and sold 81% by lot and 88% by value.

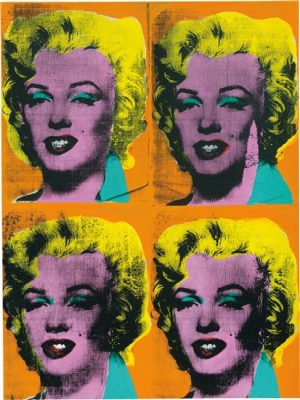

The highlight of the night was Andy Warhol’s (1928-1987) Pop Art masterpiece, Four Marilyns (1962), which sold for $38.2 million. The sale confirmed that Warhol remains a powerful presence in the art market. During the auction two other Warhol works were sold -- Flowers (1964), which brought $2.4 million and Marilyn Monroe (Marilyn) (1967), which sold for upward of $2 million. Other major sales that night included Jean-Michel Basquiat’s (1960-1988) Untitled (1961), which garnered over $4 million and Roy Lichtenstein’s (1923-1997) Still Life (1972), which also sold for upward of $4 million.

Phillips has undergone a number of changes in the past year. Following the departure of Chairman Simon de Pury in December 2012, the company changed its name from Phillips de Pury & Co. to Phillips. In February 2013, the auction house revealed 10,000-square-feet of new gallery space at the company’s headquarters on Park Avenue in Manhattan. The expansion was an attempt to compete with the major auction houses such as Sotheby’s and Christie’s.

Today, May 13, 2013 marked the end of the second-ever Frieze New York. One of the most highly anticipated art fairs, Frieze’s New York iteration took place at Randall’s Island Park and featured approximately 180 of the heaviest hitting contemporary art galleries from around the globe.

Along with its primary offerings, Frieze New York included two separate sections, Frame and Focus, which were dedicated to promising up-and-coming galleries. This year’s fair also featured seven site-specific commissions, a sculpture park, and a series of panel discussions and conversations led by high-profile artists, writers, and cultural commentators.

Frieze New York kicked off with a VIP opening on Thursday, May 9, which attracted throngs of the art world’s most elite collectors. Top sales that day included Sigmar Polke’s (1941-2010) Nachtkappel (1986) which was sold by Paris’ Galerie Thaddaeus Ropac for $4 million; an Anish Kapoor (b. 1954) sculpture sold by London’s Lisson Gallery for $764,500; and a painting of a flying tiger titled Tri Thong Minh, which was sold by New York’s Paul Kasmin gallery for $950,000.

The sister fair of Frieze London, which launched in 2001, the 2013 edition of Frieze New York was the largest stateside version of the show to date.

Sotheby’s announced its financial results for the first quarter of 2013, which ended March 31. The auction house’s first quarter total revenues were $101.7 million, a $3.2 million decrease from 2012. The decline was mainly caused by a reduction in auction commission margin from 18.1% to 15%. However, the quarter’s net auction sales increased 23% compared to last year’s first quarter.

High-grossing categories, including Impressionism as well a Modern and Contemporary Art, remained highly competitive. In an effort to enhance revenue and strengthen auction commission margins, Sotheby’s changed its buyer’s premiums structure rate on March 15, 2013. Buyers now pay 25% on the first $100,000 of a work’s selling price; 20% on the portion of the price above $100,000 but under $2 million; and 12% on any remaining amount about $2 million. Since most sales for the first quarter of 2013 took place before this shift occurred, it did not have a substantial impact on Sotheby’s results for the first quarter of 2013.

Due to the nature of the auction seasons, first and third quarters tend to bring in lower revenues than the second and fourth quarters. Typically, first quarter results are not an accurate gauge of expected full year results. Sotheby’s Chairman, President and CEO Bill Ruprecht said, “The first quarter showed a solid increase in auction sales compared to the prior year, but the results illustrate how competitive the market is for the highest value consignments. That competition resulted in lower commission margins, which is reflected on the bottom line.”

Sotheby’s has announced that they will be opening a gallery for private sales close to its London outpost on Bond Street. The gallery will be ideal for big-name collectors who prefer to do business through unpublicized sales rather than in the public auction arena.

Private sales have seen an uptick in recent years and unpublicized transactions increased at Sotheby’s by 11% in 2012. These inconspicuous sales accounted for $906.5 million of the $5.4 billion Sotheby’s brought in from auctions the same year. Most of Sotheby’s private sales come from big-ticket modern and contemporary works, which are sold when a buyer visits a viewing room within the auction house. Details surrounding these transactions are often kept under wraps. These private sales are also beneficial for the auction house because publicity costs are nonexistent.

Sotheby’s new gallery is expected to open in London during the fall of 2013.

|

|

|

|

|